Agrees to issue approximately $10 Million Convertible Notes at $13 per share, a 198% premium to July 18 close

$189 million raised year-to-date through hallmark DeFi/TradFi Accretion Flywheel strategy

SILVER SPRING, MD, July 21, 2025 (GLOBE NEWSWIRE) -- BTCS Inc. (NASDAQ:BTCS) ("BTCS" or the "Company"), a blockchain technology-focused company, short for Blockchain Technology Consensus Solutions, today announced that the combined market value of its 55,788 ETH holdings, cash1, and other liquid holdings are approximately $242.2 million, based on an ETH price of $3,600. Additionally, the Company has agreed to issue $10 million in convertible notes through its previously established $56 million arrangement with ATW Partners LLC.

While the funding is extremely modest relative to the $189 million raised year-to-date, the nearly 200% conversion premium is consistent with, and further demonstrates, BTCS's execution of its hallmark DeFi/TradFi Accretion Flywheel strategy. The Company limited this financing to $10 million as part of its strategy to maintain financial flexibility for opportunistic future leverage while maintaining its loan-to-value ratio below 40%. This approach aligns with BTCS's commitment to maximizing ETH exposure and minimizing shareholder dilution.

DeFi/TradFi Accretion Flywheel Update

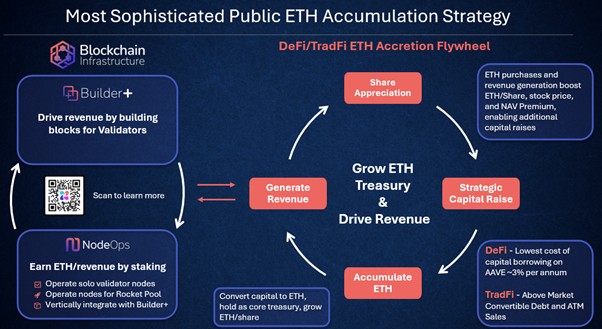

BTCS is successfully executing its DeFi/TradFi Accretion Flywheel capital formation strategy, leveraging both decentralized and traditional finance to expand its ETH holdings, capitalize on its vertically integrated operations, and enhance shareholder value. The Company has raised capital through a mix of at-the-market equity sales, above-market convertible debt, and DeFi-based borrowing, executed in alignment with its strategy to optimize ETH exposure while actively managing dilution, as detailed below.

Year-to-Date Funding Summary

ATM Sales: $132 million1 (70%)

Above-Market Convertible Debt: $17 million (9%)

Aave Stablecoin Loans (DeFi): $40 million (21%)

Total year-to-date funding: $189 million

Total Crypto & Cash Assets: $242 million1

ETH Holdings: 55,788 (average cost per ETH: $2,846), a 516% year-to-date increase

"We believe that BTCS is the most financially and operationally leveraged Ethereum play in public markets today," said Charles Allen, CEO of BTCS. "Our vertically integrated block-building and node operations are generating record revenue, and when combined with solid execution of our hallmark DeFi/TradFi Accretion Flywheel, BTCS offers investors scalable, high-growth exposure to Ethereum."

________________________________

1 Inclusive of $28.4 million ATM sales at $7.9 per share pending settlement and funds from the pending closing of the $10 million convertible note.

Above Market Convertible Note Financing

The $10 million principal amount notes are convertible into common stock at a fixed conversion price of $13 per share, representing a 198% premium over the Company's $6.57 closing stock price on Friday, July 18, 2025. The notes have a two-year maturity, expiring on July 21, 2027, include a 5% original issue discount, and bear interest at an annual rate of 6%.

In connection with the note issuance, five-year warrants will be issued at closing to purchase 879,375 shares of common stock at an exercise price of $8 per share, representing a 122% premium to the closing price on Friday, July 18, 2025. The funding is expected to close on or before Tuesday, July 22, 2025.

Notably, the financing involves no investment banking fees or restrictive terms typically associated with using an investment bank or placement agent, which could hinder the execution of the Company's DeFi/TradFi Accretion Flywheel strategy.

As part of the financing terms, the Company agreed that, while the notes remain outstanding, it will not amend its non-convertible Series V Preferred Shares to allow for conversion into common stock for a period of 18 months.

Capital Structure Update

To help investors accurately assess BTCS's intrinsic value and compare it with its peers, we're providing an updated breakdown of our capital structure. This summary provides additional information to supplement our SEC filings.

| Equity Instrument | Outstanding | Fully Diluted |

| Common Shares | 45,761,072 | 45,761,072 |

| Common Shares - Subject to Forfeiture | 1,149,801 | 1,149,801 |

| Convertible Debt (Conversion Price = $5.85) | 1,334,679 | |

| Convertible Debt (Conversion Price = $13.00) | 773,078 | |

| Convert Warrants #1 (Exercise Price = $2.75, exp. 5/13/2030) | 532,191 | |

| Convert Warrants #2 (Exercise Price = $8.00, exp. 7/21/2030) | 879,375 | |

| RD Warrant (Exercise Price = $11.50, exp. 3/4/2026) | 712,500 | |

| Employee Options (Weighted Average Exercise Price = $2.44) | 1,561,410 | |

| Total | 46,910,873 | 52,704,106 |

Approximately 16 million shares of Series V are now excluded from the fully diluted share count, as they are non-convertible and, under the terms of the note financing, cannot be amended to be convertible for 18 months.

In light of the restriction and given the new administration's growing acceptance of crypto and the broader recognition that real-world assets will be tokenized, the Company may re-explore various options to create liquidity for the Series V preferred shares, including potential tokenization on Ethereum's blockchain. However, it is still very early, and the Company can provide no guarantees or assurances that it will be able to tokenize or create liquidity for the Series V and may ultimately seek to convert the Series V to common stock when the restriction expires. As such, the Series V has been excluded from the table above.

About BTCS:

BTCS Inc. ("BTCS" or the "Company"), short for Blockchain Technology Consensus Solutions, is a U.S.-based Ethereum-first blockchain technology company committed to driving scalable revenue and ETH accumulation through its hallmark strategy, the DeFi/TradFi Accretion Flywheel, an integrated approach to capital formation and blockchain infrastructure. By combining decentralized finance ("DeFi") and traditional finance ("TradFi") mechanisms with its blockchain infrastructure operations, comprising NodeOps (staking) and Builder+ (block building), BTCS offers one of the most sophisticated opportunities for leveraged ETH exposure, driven by scalable revenue generation and a yield-focused ETH accumulation strategy. Discover how BTCS offers operational and financial leveraged exposure to Ethereum through the public markets at www.btcs.com.

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this press release constitute "forward-looking statements" within Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 including statements regarding creating high growth exposure to Ethereum, creating liquidity for Series V, and closing of the $10 million note offering. Words such as "may," "might," "will," "should," "believe," "expect," "anticipate," "estimate," "continue," "predict," "forecast," "project," "plan," "intend" or similar expressions, or statements regarding intent, belief, or current expectations, are forward-looking statements. While the Company believes these forward-looking statements are reasonable, undue reliance should not be placed on any such forward-looking statements, which are based on information available to us on the date of this release. These forward-looking statements are based upon assumptions and are subject to various risks and uncertainties, including without limitation market conditions, regulatory issues and requirements, unanticipated issues with our At-The-Market Offering facility, unexpected issues with Builder+, as well as risks set forth in the Company's filings with the Securities and Exchange Commission including its Form 10-K for the year ended December 31, 2024 which was filed on March 20, 2025. Thus, actual results could be materially different. The Company expressly disclaims any obligation to update or alter statements, whether as a result of new information, future events or otherwise, except as required by law.

For more information follow us on:

Twitter: https://x.com/NasdaqBTCS

LinkedIn: https://www.linkedin.com/company/nasdaq-btcs

Facebook: https://www.facebook.com/NasdaqBTCS

Investor Relations:

Charles Allen – CEO

X (formerly Twitter): @Charles_BTCS

Email: [email protected]

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/d2a20376-f8bd-4008-9c82-cdb4bc63b69e