Cipher Mining Surpasses Hashrate Growth Forecasts at Black Pearl and Announces June 2025 Operational Update

NEW YORK, July 02, 2025 (GLOBE NEWSWIRE) -- Cipher Mining Inc. (NASDAQ:CIFR) ("Cipher" or the "Company") today announced that Phase I of Black Pearl is now delivering ~3.4 EH/s of self-mining capacity, exceeding the Company's prior guidance of 2.5 EH/s for the second quarter of 2025. Hashrate will continue to increase at the site through the third quarter of 2025 as new mining rigs continue to be delivered in scheduled batches, gradually replacing legacy units. Cipher's total self-mining hashrate has now reached ~16.8 EH/s, and the Company maintains its expectations to scale to ~23.1 EH/s upon completion of the installation.

In addition, the Company today released its unaudited production and operations update for June 2025. While the report includes initial contributions from Black Pearl, which started hashing at the end of the month, the production numbers also reflect the Company's strategic decision to curtail more deliberately as part of its proactive 4CP avoidance strategy. This approach allowed the Company to avoid costly 4CP penalties and maintain its position as having some of the lowest power costs in the industry. Insights from June will inform further refinements to the curtailment model for the remainder of the summer.

Key Highlights

| Key Metrics | June 2025 |

| BTC Mined1 | 160 |

| BTC Sold | 58 |

| BTC Held | 1,063 |

| Deployed Mining Rigs | 104,000 |

| Month End Operating Hashrate (EH/s) | 16.8 |

| Month End Fleet Efficiency (J/TH) | 20.8 |

1 Includes June power sales estimates (based on current meter data and nodal prices) equivalent to ~5 bitcoin (using month-end bitcoin price of $107,221) and ~19 BTC mined at JV data centers representing Cipher's ownership

Bitcoin Production and Operations Updates for June 2025

Cipher produced ~1601 BTC in June. As part of its regular treasury management process, Cipher sold ~58 BTC in June, ending the month with a balance of ~1,063 BTC.

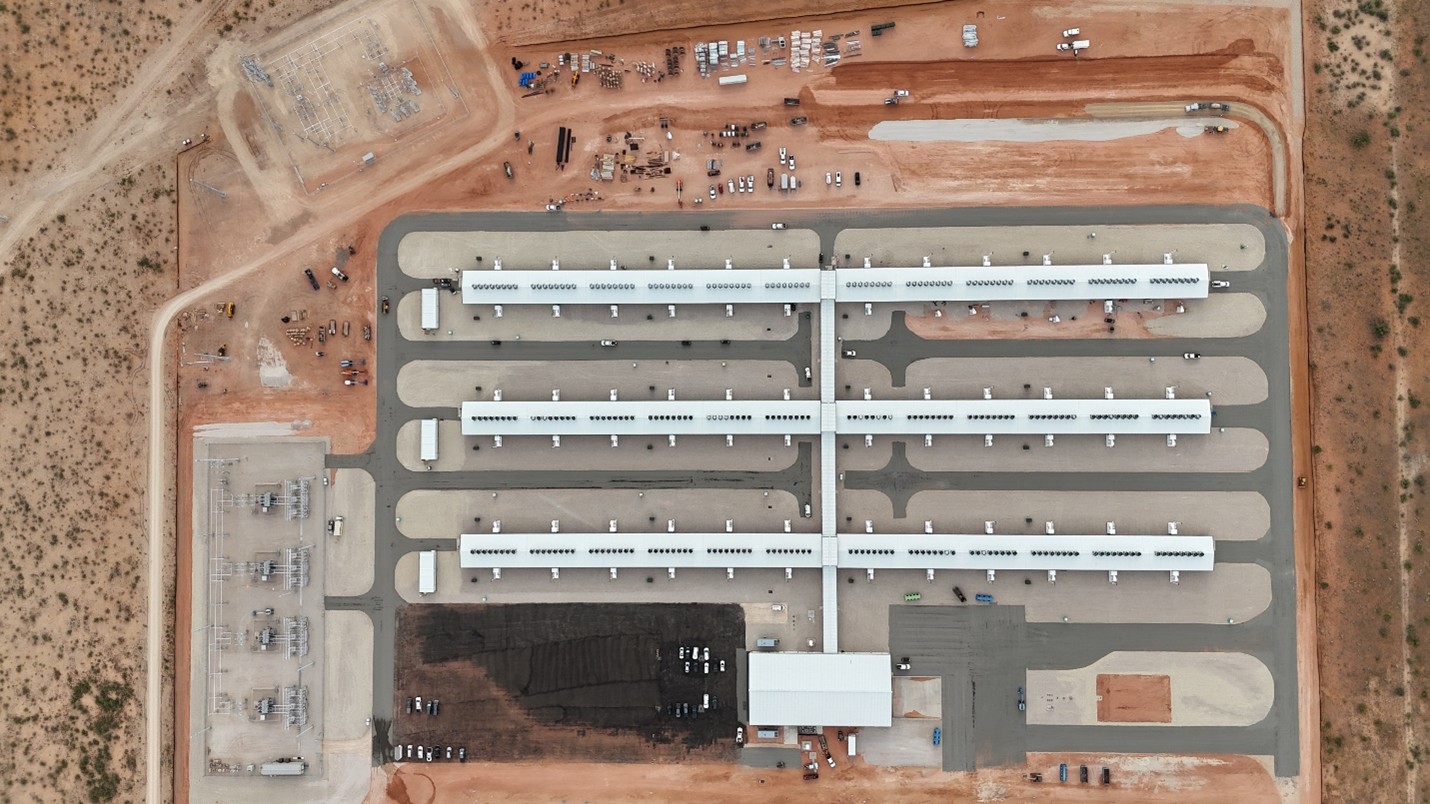

Black Pearl Phase I Infrastructure

Black Pearl Phase I Infrastructure

About Cipher

Cipher is focused on the development and operation of industrial-scale data centers for bitcoin mining and HPC hosting. Cipher aims to be a market leader in innovation, including in bitcoin mining growth, data center construction and as a hosting partner to the world's largest HPC companies. To learn more about Cipher, please visit https://www.ciphermining.com/.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of the federal securities laws of the United States. The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and includes this statement for purposes of complying with these safe harbor provisions. Any statements made in this press release that are not statements of historical fact, such as, statements about the Company's beliefs and expectations regarding its planned business model and strategy, its bitcoin mining and HPC data center development, timing and likelihood of success, capacity, functionality and timing of operation of data centers, expectations regarding the operations of data centers, such as projected hashrate, and management plans and objectives, are forward-looking statements and should be evaluated as such. These forward-looking statements generally are identified by the words "may," "will," "should," "expects," "plans," "anticipates," "could," "seeks," "intends," "targets," "projects," "contemplates," "believes," "estimates," "strategy," "future," "forecasts," "opportunity," "predicts," "potential," "would," "will likely result," "continue," and similar expressions (including the negative versions of such words or expressions).

These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Cipher and its management, are inherently uncertain. Such forward-looking statements are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including but not limited to: volatility in the price of Cipher's securities due to a variety of factors, including changes in the competitive and regulated industry in which Cipher operates, Cipher's evolving business model and strategy and efforts it may make to modify aspects of its business model or engage in various strategic initiatives, variations in performance across competitors, changes in laws and regulations affecting Cipher's business, and the ability to implement business plans, forecasts, and other expectations and to identify and realize additional opportunities. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the "Risk Factors" section of Cipher's Annual Report on Form 10-K for the fiscal year ended December 31, 2024 filed with the Securities and Exchange Commission ("SEC") on February 25, 2025, and in Cipher's subsequent filings with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Cipher assumes no obligation and, except as required by law, does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

Website Disclosure

The company maintains a dedicated investor website at https://investors.ciphermining.com/ ("Investors' Website"). Financial and other important information regarding the Company is routinely posted on and accessible through the Investors Website. Cipher uses its Investors' Website as a distribution channel of material information about the Company, including through press releases, investor presentations, reports and notices of upcoming events. Cipher intends to utilize its Investors' Website as a channel of distribution to reach public investors and as a means of disclosing material non-public information for complying with disclosure obligations under Regulation FD. In addition, you may sign up to automatically receive email alerts and other information about the Company by visiting the "Email Alerts" option under the Investors Resources section of Cipher's Investors' Website and submitting your email address.

Contacts:

Investor Contact:

Courtney Knight

Head of Investor Relations at Cipher Mining

[email protected]

Media Contact:

Ryan Dicovitsky / Kendal Till

Dukas Linden Public Relations

[email protected]

1 Includes June power sales estimates (based on current meter data and nodal prices) equivalent to ~5 bitcoin (using month-end bitcoin price of $107,221) and ~19 BTC mined at JV data centers representing Cipher's ownership

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/e617a33f-8d22-4573-adb6-ef975fcc5000

https://www.globenewswire.com/NewsRoom/AttachmentNg/7922fa8e-f1c3-4660-bcbe-2f4cd1efbf08