Hecla Reports Exploration Results and Mineral Reserves

Second highest silver reserves in company history

Hecla Mining Company ((HL) today reported exploration results and year-end mineral reserves. Significant exploration success at key properties provides the base for future resource growth while silver reserves reached the second highest in Hecla's history.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250212842244/en/

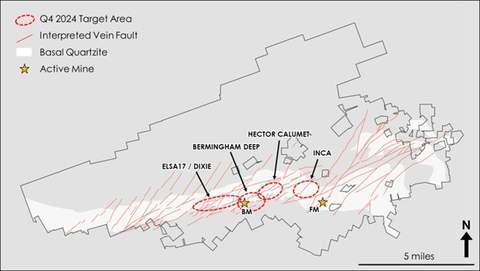

Figure 1: District geology with fourth quarter 2024 drill target locations. (Graphic: Business Wire)

HIGHLIGHTS

- Achieved near-record silver reserves, reaching 240 million ounces and approaching an all-time high

- Fully replaced silver production from reserves through strategic reserve replacement across operations

- Restored nearly all silver reserves at Greens Creek through targeted exploration

- Grew Keno Hill reserves by 17% to reach 64 million silver ounces

- Maintained gold reserves with production replaced and added 21 thousand ounces at Casa Berardi

- Demonstrated robust economics using conservative pricing ($22/oz silver, $1,900/oz gold)

- Disciplined resource estimation with updated cut-off grades reflecting current costs

- Discovered and expanded high-grade zones across multiple properties through focused drilling

- Accelerated development of high-priority exploration targets to drive future growth

"Hecla's silver reserves stand at 240 million ounces, the second-highest level in our 134-year history and only 1 million ounces below our peak in 2022," said Rob Krcmarov, President and CEO. "Our 2024 exploration program continued to deliver exceptional results at both Keno Hill and Greens Creek while Keno Hill reserves grew by over 17% and silver production was nearly replaced at Greens Creek. These achievements position Hecla for continued growth as the largest silver producer in the U.S. and Canada and lay the foundation for sustained future growth."

Kurt Allen, Vice President of Exploration, commented on the exploration success: "The 2024 drilling program has significantly advanced our understanding of the high-grade mineralization controls at both Keno Hill and Greens Creek. At Keno Hill, the Bermingham Footwall and Main Vein zones continue to deliver exceptional silver grades over mineable widths and remain open for expansion. The emerging cluster of high-grade silver values beneath the Bermingham Deep Northeast Ore Zone is particularly exciting, suggesting proximity to a new ore-shoot that will be a key focus of our 2025 drilling program. At Greens Creek, the strong results from the West Zone and 5250 Zone support our view that this world-class deposit continues to hold significant exploration potential."

EXPLORATION HIGHLIGHTS BY PROPERTY

Select drill highlights from the company's exploration programs include the following drill holes, additional drill holes and details are included later in this release.

Keno Hill (Yukon Territory)

Bermingham Vein Zone – Notable Intercepts

- Bear Vein: 13.2 oz/ton silver, 2.6% lead, and 0.9% zinc over 7.5 feet

-

Footwall Vein: 36.6 oz/ton silver, 3.0% lead, and 0.9% zinc over 11.2 feet

- Includes: 48.4 oz/ton silver, 3.7% lead, and 1.0% zinc over 8.1 feet

- Main Vein: 42.8 oz/ton silver, 9.3% lead, and 9.7% zinc over 6.8 feet

Operational Context:

Underground definition drilling continued to expand mineralization in the high-grade Bermingham Bear Zone Veins, while surface exploration focused on new discoveries. The Footwall and Main Vein mineralized zones remain open for expansion at depth, with further drilling planned in the first half of 2025.

Greens Creek (Alaska)

West Zone – Notable Intercepts:

- 34.6 oz/ton silver, 0.44 oz/ton gold, 2.8% lead and 5.9% zinc over 12.1 feet

- 40.1 oz/ton silver, 0.36 oz/ton gold, 4.3% lead and 8.2% zinc over 8.0 feet

9A Zone – Notable Intercepts:

- 10.8 oz/ton silver, 0.21 oz/ton gold, 4.5% lead, and 8.7% lead over 17.3 feet

- 11.1 oz/ton silver, 0.03 oz/ton gold, 4.9% lead, and 11.6% zinc over 18.5 feet

- 27.4 oz/ton silver, 0.03 oz/ton gold, 5.8% lead, and 11.5% zinc over 6.2 feet

5250 Zone – Notable Intercepts

- 24.3 oz/ton silver, 0.07 oz/ton gold, 4.3% lead and 9.2% zinc over 46.6 feet

- 29.7 oz/ton silver, 0.08 oz/ton gold, 3.4% lead and 4.4% zinc over 24.3 feet

RESERVES & RESOURCES HIGHLIGHTS

- Silver reserves at 240 million ounces, an increase of 1% over last year, with additions at Keno Hill.

- On a consolidated basis, while the Company mined 18.7 million ounces of silver during 2024, it successfully replaced 14.6 million ounces in reserves. The difference primarily reflects production from areas outside of reserve blocks.

- Keno Hill reserves increased almost 17% to 64 million silver ounces.

- Gold reserves are flat over last year with production replaced and a slight increase at Casa Berardi.

Reserves And Resources Summary

Year-End 2024 Position:

- Proven and Probable silver reserves: 240 million ounces

- Measured and Indicated silver resources: 180 million ounces

- Inferred silver resources: 492 million ounces

- Proven and Probable gold reserves: 2.2 million ounces

- Measured and Indicated gold resources: 4.3 million ounces

- Inferred gold resources: 6.2 million ounces

A breakdown of the Company's reserves and resources along with metal price assumptions are set out in Table A at the end of this news release.

EXPLORATION UPDATE

Keno Hill, Yukon Territory

Fourth quarter drilling at Keno Hill substantially expanded high-grade mineralization through an aggressive dual-focus program of underground definition and surface exploration drilling. Underground drilling completed 7,100 feet, concentrating on resource conversion and expansion of the high-grade Bermingham Bear Zone Veins. Concurrent surface exploration deployed five core drills to complete 28,000 feet across multiple promising targets including the Bermingham Deep, Elsa 17-Dixie, Inca, and Hector-Calumet areas (Figure 1).

Definition drilling in the Bear Zone veins yielded significant results, particularly in the Footwall and Main Veins where high-grade mineralization was extended both at depth and along strike. While drilling in the Bear Vein identified narrow vein mineralization between the Ursa and Arctic faults, the most substantial gains came from the Footwall and Main Veins, where strong high-grade intercepts significantly expanded the known mineralized zones. Both the Footwall and Main Vein zones remain open at depth, with further drilling planned for the first half of 2025 to test their expansion potential. Assay highlights include (reported widths are estimates of true width):

- Bear Vein: 13.2 oz/ton silver, 2.6% lead, and 0.9% zinc over 7.5 feet

- Bear Vein: 12.6 oz/ton silver, 1.9% lead, and 0.1% zinc over 5.7 feet

-

Footwall Vein: 37.3 oz/ton silver, 4.8% lead, and 1.2% zinc over 12.5 feet

- Includes: 117.2 oz/ton silver, 15.9% lead, and 10.2% zinc over 0.9 feet

-

Footwall Vein: 36.6 oz/ton silver, 3.0% lead, and 0.9% zinc over 11.2 feet

- Includes: 48.4 oz/ton silver, 3.7% lead, and 1.0% zinc over 8.1 feet

- Main Vein: 42.8 oz/ton silver, 9.3% lead, and 9.7% zinc over 6.8 feet

- Main Vein: 23.8 oz/ton silver, 2.9% lead, and 0.9% zinc over 7.5 feet

Surface exploration drilling delivered exciting results from both the Bermingham system and Inca Vein target areas.

At Bermingham, drilling intercepted significant mineralization across multiple veins, highlighted by an 11.3-foot intersection in the Footwall Vein grading 11.1 oz/ton silver with associated base metals. This intercept, located beneath the northeastern edge of the Bermingham Deep Northeast Ore Zone, suggests proximity to a new ore-shoot controlled by an interpreted vein intersection. The area is slated for follow-up drilling in 2025.

At the Inca Vein target, initial drilling has outlined over 800 feet of mineralized strike length, delivering exceptional results including 22.3 feet grading 18.1 oz/ton silver, 16.1% zinc, and significant indium values. The zone remains open for expansion in all directions, demonstrating strong potential for resource growth. The best intercept included 14.3 feet grading 26.1 oz/ton silver and 20.9% zinc, with notable indium credits of 7.0 oz/ton.

Greens Creek, Alaska

At Greens Creek, two underground drilling rigs completed 27 drillholes, totaling 17,083 feet. Definition drilling was focused on resource conversion and exploration and resulted in extending mineralization from known resources. Underground definition drilling targeted the 9A, East, and Gallagher zones and exploration targeted the Gallagher Zone (Figure 5). Assay results were received during the quarter from the 5250, 9A, Gallagher, West, 200S, and UPP zones.

Underground definition drilling delivered mixed but overall positive results across multiple zones. At the Gallagher Zone, four drillholes across two sections encountered elevated alteration, with 61% of received assays from 23 holes expected to positively impact the resource. Highlights from this drilling include:

- 8.0 oz/ton silver, 0.15 oz/ton gold, 4.7% lead, and 10.4% zinc over 11.1 feet

During the quarter, assay results for the 5250 Zone were received for 22 drillholes, targeting 13 cross-sections, of which 41% are expected to have a positive impact on the resource. Highlights from this drilling include:

- 24.3 oz/ton silver, 0.07 oz/ton gold, 4.3% lead and 9.2% zinc over 46.6 feet

- 29.7 oz/ton silver, 0.08 oz/ton gold, 3.4% lead and 4.4% zinc over 24.3 feet

During the quarter, assay results for the West Zone were received for 15 drillholes, targeting eight cross-sections, of which 40% are expected to have a positive impact on the resource. Highlights from this drilling include:

- 34.6 oz/ton silver, 0.44 oz/ton gold, 2.8% lead and 5.9% zinc over 12.1 feet

- 40.1 oz/ton silver, 0.36 oz/ton gold, 4.3% lead and 8.2% zinc over 8.0 feet

The 9A Zone drilling campaign successfully established important continuity across several gaps within the zone. Highlights from this drilling include:

- 10.8 oz/ton silver, 0.21 oz/ton gold, 4.5% lead, and 8.7% lead over 17.3 feet

- 11.1 oz/ton silver, 0.03 oz/ton gold, 5.0% lead, and 11.6% zinc over 18.5 feet

- 27.4 oz/ton silver, 0.03 oz/ton gold, 5.8% lead, and 11.5% zinc over 6.2 feet

Detailed drill assay highlights can be found in Table B at the end of the release.

ABOUT HECLA

Founded in 1891, Hecla Mining Company (NYSE:HL) is the largest silver producer in the United States and Canada. In addition to operating mines in Alaska, Idaho, and Quebec, Canada, the Company is developing a mine in the Yukon, Canada, and owns a number of exploration and pre-development projects in world-class silver and gold mining districts throughout North America.

Cautionary Statements Regarding Estimates and Forward-Looking Statements

Statements made or information provided in this news release that are not historical facts are "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbor created by such sections and other applicable laws, and "forward-looking information" within the meaning of Canadian securities laws. When a forward-looking statement expresses or implies an expectation or belief as to future events or results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. However, such statements are subject to risks, uncertainties and other factors, which could cause actual results to differ materially from future results expressed, projected or implied by the forward-looking statements. Forward-looking statements often address our expected future business and financial performance and financial condition and often contain words such as "anticipate," "intend," "plan," "will," "could," "would," "estimate," "should," "expect," "believe," "project," "target," "indicative," "preliminary," "potential" and similar expressions. Estimates or expectations of future events or results are based upon certain assumptions, which may prove to be incorrect, which could cause actual results to differ from forward-looking statements. Such assumptions, include, but are not limited to: (i) there being no significant change to current geotechnical, metallurgical, hydrological and other physical conditions; (ii) permitting, development, operations and expansion of the Company's projects being consistent with current expectations and mine plans; (iii) political/regulatory developments in any jurisdiction in which the Company operates being consistent with its current expectations; (iv) certain price assumptions for gold, silver, lead and zinc; (v) prices for key supplies being approximately consistent with current levels; (vi) the accuracy of our current mineral reserve and mineral resource estimates; (vii) the Company's plans for development and production will proceed as expected and will not require revision as a result of risks or uncertainties, whether known, unknown or unanticipated; (viii) sufficient workforce is available and trained to perform assigned tasks; (ix) weather patterns and rain/snowfall within normal seasonal ranges so as not to impact operations; (x) relations with interested parties, including Native Americans, remain productive; and (xi) factors do not arise that reduce available cash balances.

In addition, material risks that could cause actual results to differ from forward-looking statements include, but are not limited to: (i) gold, silver and other metals price volatility; (ii) operating risks; (iii) currency fluctuations; (iv) increased production costs and variances in ore grade or recovery rates from those assumed in mining plans; (v) community relations; (vi) conflict resolution and outcome of projects or oppositions; (vii) litigation, political, regulatory, labor and environmental risks; (viii) exploration risks and results, including that mineral resources are not mineral reserves, they do not have demonstrated economic viability and there is no certainty that they can be upgraded to mineral reserves through continued exploration; (ix) the failure of counterparties to perform their obligations under hedging instruments; (x) we take a material impairment charge on any of our assets; and (xi) inflation causes our costs to rise more than we currently expect. For a more detailed discussion of such risks and other factors, see the Company's 2024 Annual Report on Form 10-K, to be filed with the Securities and Exchange Commission ("SEC") on February 13, 2025. The Company does not undertake any obligation to release publicly, revisions to any "forward-looking statement," including, without limitation, outlook, to reflect events or circumstances after the date of this presentation, or to reflect the occurrence of unanticipated events, except as may be required under applicable securities laws. Investors should not assume that any lack of update to a previously issued "forward-looking statement" constitutes a reaffirmation of that statement. Continued reliance on "forward-looking statements" is at investors' own risk.

Cautionary Statements to Investors on Reserves and Resources

This news release uses the terms "mineral resources," "measured mineral resources," "indicated mineral resources" and "inferred mineral resources". Mineral resources that are not mineral reserves do not have demonstrated economic viability. You should not assume that all or any part of measured or indicated mineral resources will ever be converted into mineral reserves. Further, inferred mineral resources have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically, and an inferred mineral resource may not be considered when assessing the economic viability of a mining project, and may not be converted to a mineral reserve. We report reserves and resources under the SEC's mining disclosure rules ("S-K 1300") and Canada's National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101") because we are a "reporting issuer" under Canadian securities laws. Unless otherwise indicated, all resource and reserve estimates contained in this press release have been prepared in accordance with S-K 1300 as well as NI 43-101.

Qualified Person (QP)

Kurt D. Allen, MSc., CPG, VP -Exploration of Hecla Mining Company and Keith Blair, MSc., CPG, Chief Geologist of Hecla Limited, who serve as a Qualified Person under S-K 1300 and NI 43-101, supervised the preparation of the scientific and technical information concerning Hecla's mineral projects in this news release. Technical Report Summaries for the Company's Greens Creek, Lucky Friday, Casa Berardi and Keno Hill properties are filed as exhibits 96.1 - 96.4, respectively, to the Company's Annual Report on Form 10-K for the year ended December 31, 2023 and are available at www.sec.gov. Information regarding data verification, surveys and investigations, quality assurance program and quality control measures and a summary of analytical or testing procedures for (i) the Greens Creek Mine are contained in its Technical Report Summary and in its NI 43-101 technical report titled "Technical Report for the Greens Creek Mine" effective date December 31, 2018, (ii) the Lucky Friday Mine are contained in its Technical Report Summary and in its NI 43-101 technical report titled "Technical Report for the Lucky Friday Mine Shoshone County, Idaho, USA" effective date April 2, 2014, (iii) Casa Berardi are contained in its Technical Report Summary and in its NI 43-101 technical report titled "Technical Report on the Casa Berardi Mine, Northwestern Quebec, Canada" effective date December 31, 2023, (iv) Keno Hill are contained in its Technical Report Summary titled "S-K 1300 Technical Report Summary on the Keno Hill Mine, Yukon, Canada" and in its NI 43-101 technical report titled "Technical Report on the Keno Hill Mine, Yukon, Canada" effective date December 31, 2023, and (v) the San Sebastian Mine, Mexico, are contained in a NI 43-101 technical report prepared for Hecla titled "Technical Report for the San Sebastian Ag-Au Property, Durango, Mexico" effective date September 8, 2015. Also included in each Technical Report Summary and technical report listed above is a description of the key assumptions, parameters and methods used to estimate mineral reserves and resources and a general discussion of the extent to which the estimates may be affected by any known environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant factors. Information regarding data verification, surveys and investigations, quality assurance program and quality control measures and a summary of sample, analytical or testing procedures are contained in NI 43-101 technical reports prepared for Klondex Mines Ltd. for (i) the Fire Creek Mine (technical report dated March 31, 2018), (ii) the Hollister Mine (technical report dated May 31, 2017, amended August 9, 2017), and (iii) the Midas Mine (technical report dated August 31, 2014, amended April 2, 2015). Information regarding data verification, surveys and investigations, quality assurance program and quality control measures and a summary of sample, analytical or testing procedures are contained in a NI 43-101 technical reports prepared for ATAC Resources Ltd. for (i) the Osiris Project (technical report dated July 28, 2022) and (ii) the Tiger Project (technical report dated February 27, 2020). Copies of these technical reports are available under the SEDAR profiles of Klondex Mines Unlimited Liability Company and ATAC Resources Ltd., respectively, at www.sedar.com (the Fire Creek technical report is also available under Hecla's profile on SEDAR). Mr. Allen and Mr. Blair reviewed and verified information regarding drill sampling, data verification of all digitally collected data, drill surveys and specific gravity determinations relating to all the mines. The review encompassed quality assurance programs and quality control measures including analytical or testing practice, chain-of-custody procedures, sample storage procedures and included independent sample collection and analysis. This review found the information and procedures meet industry standards and are adequate for Mineral Resource and Mineral Reserve estimation and mine planning purposes.

Table A Hecla Mining Company - Reserves and Resources – 12/31/2024 (1) |

|||||||||||

Proven Reserves (1) |

|||||||||||

|

|

Silver |

Gold |

Lead |

Zinc |

Silver |

Gold |

Lead |

Zinc |

||

Asset |

Location |

Ownership |

Tons (000) |

(oz/ton) |

(oz/ton) |

% |

% |

(000 oz) |

(000 oz) |

Tons |

Tons |

Greens Creek (2,3) |

United States |

100.0% |

9 |

7.6 |

0.07 |

2.4 |

6.5 |

70 |

1 |

220 |

600 |

Lucky Friday (2,4) |

United States |

100.0% |

5,285 |

11.9 |

- |

7.6 |

3.6 |

62,825 |

- |

400,400 |

189,860 |

Casa Berardi Underground (2,5) |

Canada |

100.0% |

87 |

- |

0.15 |

- |

- |

- |

13 |

- |

- |

Casa Berardi Open Pit (2,5) |

Canada |

100.0% |

4,958 |

- |

0.08 |

- |

- |

- |

415 |

- |

- |

Keno Hill (2,6) |

Canada |

100.0% |

13 |

28.1 |

- |

3.0 |

1.6 |

364 |

- |

380 |

200 |

Total |

|

|

10,353 |

|

|

|

|

63,259 |

429 |

401,000 |

190,660 |

|

|

|

|

|

|

|

|

|

|

|

|

Probable Reserves (7) |

|||||||||||

|

Silver |

Gold |

Lead |

Zinc |

Silver |

Gold |

Lead |

Zinc |

|||

Asset |

Location |

Ownership |

Tons (000) |

(oz/ton) |

(oz/ton) |

% |

% |

(000 oz) |

(000 oz) |

(Tons) |

(Tons) |

Greens Creek (2,3) |

United States |

100.0% |

10,438 |

9.9 |

0.08 |

2.3 |

6.2 |

103,641 |

864 |

240,450 |

645,410 |

Lucky Friday (2,4) |

United States |

100.0% |

790 |

11.4 |

- |

7.6 |

3.1 |

9,011 |

- |

60,210 |

24,620 |

Casa Berardi Underground (2,5) |

Canada |

100.0% |

391 |

- |

0.15 |

- |

- |

- |

59 |

- |

- |

Casa Berardi Open Pit (2,5) |

Canada |

100.0% |

10,457 |

- |

0.08 |

- |

- |

- |

804 |

- |

- |

Keno Hill (2,6) |

Canada |

100.0% |

2,630 |

24.3 |

0.01 |

2.4 |

2.4 |

63,914 |

17 |

63,440 |

62,790 |

Total |

|

|

24,706 |

|

|

|

|

176,566 |

1,745 |

364,100 |

732,820 |

|

|

|

|

|

|

|

|

|

|

|

|

Proven and Probable Reserves |

|||||||||||

|

Silver |

Gold |

Lead |

Zinc |

Silver |

Gold |

Lead |

Zinc |

|||

Asset |

Location |

Ownership |

Tons (000) |

(oz/ton) |

(oz/ton) |

% |

% |

(000 oz) |

(000 oz) |

(Tons) |

(Tons) |

Greens Creek (2,3) |

United States |

100.0% |

10,447 |

9.9 |

0.08 |

2.3 |

6.2 |

103,711 |

865 |

240,670 |

646,010 |

Lucky Friday (2,4) |

United States |

100.0% |

6,075 |

11.8 |

- |

7.6 |

3.5 |

71,836 |

- |

460,610 |

214,480 |

Casa Berardi Underground (2,5) |

Canada |

100.0% |

479 |

- |

0.15 |

- |

- |

- |

72 |

- |

- |

Casa Berardi Open Pit (2,5) |

Canada |

100.0% |

15,415 |

- |

0.08 |

- |

- |

- |

1,220 |

- |

- |

Keno Hill (2,6) |

Canada |

100.0% |

2,643 |

24.3 |

0.01 |

2.4 |

2.4 |

64,278 |

17 |

63,820 |

62,990 |

Total |

|

|

35,059 |

|

|

|

|

239,825 |

2,174 |

765,100 |

923,480 |

(1) |

The term "reserve" means an estimate of tonnage and grade or quality of indicated and measured mineral resources that, in the opinion of the qualified person, can be the basis of an economically viable project. |

|

|

More specifically, it is the economically mineable part of a measured or indicated mineral resource, which includes diluting materials and allowances for losses that may occur when the material is mined or extracted. |

|

|

The term "proven reserves" means the economically mineable part of a measured mineral resource and can only result from conversion of a measured mineral resource. See footnotes 8 and 9 below. |

|

(2) |

Mineral reserves are based on $22/oz silver, $1900/oz gold, $0.90/lb lead, $1.15/lb zinc, unless otherwise stated. All Mineral Reserves are reported in-situ with estimates of mining dilution and mining loss. |

|

(3) |

The reserve NSR cut-off values for Greens Creek are $230/ton for all zones; metallurgical recoveries (actual 2024): 79% for silver, 72% for gold, 81% for lead, and 89% for zinc. |

|

(4) |

The reserve NSR cut-off values for Lucky Friday are $225/ton for the 30 Vein and $236/ton for the Intermediate Veins; metallurgical recoveries (actual 2024): 94% for silver, 94% for lead, and 86% for zinc |

|

(5) |

The average reserve cut-off grades at Casa Berardi are 0.12 oz/ton gold (4.1 g/tonne) underground and 0.03 oz/ton gold (1.1 g/tonne) for open pit. Metallurgical recovery (actual 2024): 85% for gold; US$/CAN$ exchange rate: 1:1.35. |

|

(6) |

The reserve NSR cut-off value at Keno Hill is $235.20/ton (CAN$350/tonne), Metallurgical recovery (actual 2024): 97% for silver, 95% for lead, 87% for zinc; US$/CAN$ exchange rate: 1:1.35 |

|

(7) |

The term "probable reserves" means the economically mineable part of an indicated and, in some cases, a measured mineral resource. See footnotes 9 and 10 below. |

|

Totals may not represent the sum of parts due to rounding |

||

Mineral Resources - 12/31/2024 (8)

|

|||||||||||||

Measured Resources (9) |

|||||||||||||

|

|

|

|

Silver |

Gold |

Lead |

Zinc |

Copper |

Silver |

Gold |

Lead |

Zinc |

Copper |

Asset |

Location |

Ownership |

Tons (000) |

(oz/ton) |

(oz/ton) |

% |

% |

% |

(000 oz) |

(000 oz) |

(Tons) |

(Tons) |

(Tons) |

Greens Creek (12,13) |

United States |

100.0% |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Lucky Friday (12,14) |

United States |

100.0% |

3,781 |

8.7 |

- |

5.8 |

2.6 |

- |

32,795 |

- |

217,490 |

99,840 |

- |

Casa Berardi Underground (12,15) |

Canada |

100.0% |

1,486 |

- |

0.20 |

- |

- |

- |

- |

300 |

- |

- |

- |

Casa Berardi Open Pit (12,15) |

Canada |

100.0% |

84 |

- |

0.03 |

- |

- |

- |

- |

3 |

- |

- |

- |

Keno Hill (12,16) |

Canada |

100.0% |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

San Sebastian - Oxide(17) |

Mexico |

100.0% |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

San Sebastian - Sulfide (17) |

Mexico |

100.0% |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Fire Creek (18,19) |

United States |

100.0% |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Hollister (18,20) |

United States |

100.0% |

19 |

4.7 |

0.57 |

- |

- |

- |

88 |

11 |

- |

- |

- |

Midas (18,21) |

United States |

100.0% |

2 |

7.1 |

0.62 |

- |

- |

- |

15 |

1 |

- |

- |

- |

Heva (22) |

Canada |

100.0% |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Hosco (22) |

Canada |

100.0% |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Star (12,23) |

United States |

100.0% |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Rackla - Tiger Open Pit (29) |

Canada |

100.0% |

881 |

- |

0.09 |

- |

- |

- |

- |

75 |

- |

- |

- |

Rackla - Tiger Underground (29) |

Canada |

100.0% |

32 |

- |

0.06 |

- |

- |

- |

- |

2 |

- |

- |

- |

Rackla - Osiris Open Pit (30) |

Canada |

100.0% |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Rackla - Osiris Underground (30) |

Canada |

100.0% |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Total |

|

|

6,285 |

|

|

|

|

|

32,898 |

392 |

217,490 |

99,840 |

- |

Indicated Resources (10) |

|||||||||||||

|

|

|

Silver |

Gold |

Lead |

Zinc |

Copper |

Silver |

Gold |

Lead |

Zinc |

Copper |

|

Asset |

Location |

Ownership |

Tons

|

(oz/ton) |

(oz/ton) |

% |

% |

% |

(000 oz) |

(000 oz) |

(Tons) |

(Tons) |

(Tons) |

Greens Creek (12,13) |

United States |

100.0% |

7,619 |

14.1 |

0.10 |

3.0 |

8.0 |

- |

107,226 |

760 |

227,360 |

607,600 |

- |

Lucky Friday (12,14) |

United States |

100.0% |

845 |

8.7 |

- |

6.6 |

2.3 |

- |

7,350 |

- |

55,890 |

19,700 |

- |

Casa Berardi Underground (12,15) |

Canada |

100.0% |

3,522 |

- |

0.17 |

- |

- |

- |

- |

594 |

- |

- |

- |

Casa Berardi Open Pit (12,15) |

Canada |

100.0% |

126 |

- |

0.03 |

- |

- |

- |

- |

4 |

- |

- |

- |

Keno Hill (12,16) |

Canada |

100.0% |

1,050 |

13.7 |

0.01 |

1.1 |

2.1 |

- |

14,431 |

12 |

11,610 |

22,460 |

- |

San Sebastian - Oxide (17) |

Mexico |

100.0% |

1,233 |

6.6 |

0.10 |

- |

- |

- |

8,146 |

121 |

- |

- |

- |

San Sebastian - Sulfide (17) |

Mexico |

100.0% |

1,164 |

5.3 |

0.01 |

2.0 |

3.1 |

1.3 |

6,211 |

15 |

23,500 |

35,900 |

15,240 |

Fire Creek (18,19) |

United States |

100.0% |

197 |

0.8 |

0.37 |

- |

- |

- |

162 |

73 |

- |

- |

- |

Hollister (18,20) |

United States |

100.0% |

74 |

1.8 |

0.56 |

- |

- |

- |

134 |

41 |

- |

- |

- |

Midas (18,21) |

United States |

100.0% |

95 |

5.4 |

0.40 |

- |

- |

- |

514 |

38 |

- |

- |

- |

Heva (22) |

Canada |

100.0% |

1,208 |

- |

0.05 |

- |

- |

- |

- |

62 |

- |

- |

- |

Hosco (22) |

Canada |

100.0% |

32,152 |

- |

0.03 |

- |

- |

- |

- |

1,097 |

- |

- |

- |

Star (12,23) |

United States |

100.0% |

834 |

3.4 |

- |

7.2 |

8.5 |

- |

2,820 |

- |

60,120 |

70,450 |

- |

Rackla - Tiger Open Pit (29) |

Canada |

100.0% |

3,116 |

- |

0.10 |

- |

- |

- |

- |

311 |

- |

- |

- |

Rackla - Tiger Underground (29) |

Canada |

100.0% |

960 |

- |

0.08 |

- |

- |

- |

- |

76 |

- |

- |

- |

Rackla - Osiris Open Pit (30) |

Canada |

100.0% |

4,843 |

- |

0.12 |

- |

- |

- |

- |

577 |

- |

- |

- |

Rackla - Osiris Underground (30) |

Canada |

100.0% |

927 |

- |

0.13 |

- |

- |

- |

- |

123 |

- |

- |

- |

Total |

|

|

59,963 |

|

|

|

|

|

146,993 |

3,905 |

378,480 |

756,110 |

15,240 |

Measured & Indicated Resources |

|||||||||||||

|

|

|

Silver |

Gold |

Lead |

Zinc |

Copper |

Silver |

Gold |

Lead |

Zinc |

Copper |

|

Asset |

Location |

Ownership |

Tons

|

(oz/ton) |

(oz/ton) |

% |

% |

% |

(000 oz) |

(000 oz) |

(Tons) |

(Tons) |

(Tons) |

Greens Creek (12,13) |

United States |

100.0% |

7,619 |

14.1 |

0.10 |

3.0 |

8.0 |

- |

107,226 |

760 |

227,360 |

607,600 |

- |

Lucky Friday (12,14) |

United States |

100.0% |

4,627 |

8.7 |

- |

6.2 |

2.5 |

- |

40,145 |

- |

273,380 |

119,540 |

- |

Casa Berardi Underground(12,15) |

Canada |

100.0% |

5,007 |

- |

0.18 |

- |

- |

- |

- |

895 |

- |

- |

- |

Casa Berardi Open Pit (12,15) |

Canada |

100.0% |

210 |

- |

0.03 |

- |

- |

- |

- |

6 |

- |

- |

- |

Keno Hill (12,16) |

Canada |

100.0% |

1,050 |

13.7 |

0.01 |

1.1 |

2.1 |

- |

14,431 |

12 |

11,610 |

22,460 |

- |

San Sebastian - Oxide (17) |

Mexico |

100.0% |

1,233 |

6.6 |

0.10 |

- |

- |

- |

8,146 |

121 |

- |

- |

- |

San Sebastian - Sulfide (17) |

Mexico |

100.0% |

1,164 |

5.3 |

0.01 |

2.0 |

3.1 |

1.3 |

6,211 |

15 |

23,500 |

35,900 |

15,240 |

Fire Creek (18,19) |

United States |

100.0% |

197 |

0.8 |

0.37 |

- |

- |

- |

162 |

73 |

- |

- |

- |

Hollister (18,20) |

United States |

100.0% |

93 |

2.4 |

0.56 |

- |

- |

- |

223 |

52 |

- |

- |

- |

Midas (18,21) |

United States |

100.0% |

97 |

5.5 |

0.40 |

- |

- |

- |

529 |

39 |

- |

- |

- |

Heva (22) |

Canada |

100.0% |

1,208 |

- |

0.05 |

- |

- |

- |

- |

62 |

- |

- |

- |

Hosco (22) |

Canada |

100.0% |

32,152 |

- |

0.03 |

- |

- |

- |

- |

1,097 |

- |

- |

- |

Star (12,23) |

United States |

100.0% |

834 |

3.4 |

- |

7.2 |

8.5 |

- |

2,820 |

- |

60,120 |

70,450 |

- |

Rackla - Tiger Open Pit (29) |

Canada |

100.0% |

3,997 |

- |

0.10 |

- |

- |

- |

- |

386 |

- |

- |

- |

Rackla - Tiger Underground(29) |

Canada |

100.0% |

991 |

- |

0.08 |

- |

- |

- |

- |

78 |

- |

- |

- |

Rackla - Osiris Open Pit (30) |

Canada |

100.0% |

4,843 |

- |

0.12 |

- |

- |

- |

- |

577 |

- |

- |

- |

Rackla - Osiris Underground(30) |

Canada |

100.0% |

927 |

- |

0.13 |

- |

- |

- |

- |

123 |

- |

- |

- |

Total |

|

|

66,248 |

|

|

|

|

|

179,891 |

4,297 |

595,970 |

855,950 |

15,240 |

Inferred Resources (11) |

|||||||||||||

|

|

|

|

Silver |

Gold |

Lead |

Zinc |

Copper |

Silver |

Gold |

Lead |

Zinc |

Copper |

Asset |

Location |

Ownership |

Tons (000) |

(oz/ton) |

(oz/ton) |

% |

% |

% |

(000 oz) |

(000 oz) |

(Tons) |

(Tons) |

(Tons) |

Greens Creek (12,13) |

United States |

100.0% |

1,878 |

13.4 |

0.08 |

2.9 |

6.9 |

- |

25,106 |

151 |

54,010 |

130,120 |

- |

Lucky Friday (12,14) |

United States |

100.0% |

3,811 |

10.3 |

- |

7.7 |

3.2 |

- |

39,183 |

- |

293,010 |

121,710 |

- |

Casa Berardi Underground(12,15) |

Canada |

100.0% |

2,076 |

- |

0.20 |

- |

- |

- |

- |

408 |

- |

- |

- |

Casa Berardi Open Pit (12,15) |

Canada |

100.0% |

577 |

- |

0.10 |

- |

- |

- |

- |

57 |

- |

- |

- |

Keno Hill (12,16) |

Canada |

100.0% |

1,300 |

14.8 |

0.005 |

1.3 |

2.7 |

- |

19,270 |

6 |

16,450 |

34,940 |

- |

San Sebastian - Oxide (17) |

Mexico |

100.0% |

2,163 |

7.1 |

0.06 |

- |

- |

- |

15,364 |

134 |

- |

- |

- |

San Sebastian - Sulfide (17) |

Mexico |

100.0% |

326 |

4.3 |

0.01 |

1.7 |

2.6 |

0.9 |

1,388 |

4 |

5,680 |

8,420 |

3,090 |

Fire Creek (18,19) |

United States |

100.0% |

1,197 |

0.4 |

0.42 |

- |

- |

- |

524 |

500 |

- |

- |

- |

Fire Creek - Open Pit (24) |

United States |

100.0% |

74,584 |

0.1 |

0.03 |

- |

- |

- |

5,232 |

2,178 |

- |

- |

- |

Hollister (18,20) |

United States |

100.0% |

742 |

2.7 |

0.40 |

- |

- |

- |

2,037 |

294 |

- |

- |

- |

Midas (18,21) |

United States |

100.0% |

1,480 |

5.3 |

0.44 |

- |

- |

- |

7,918 |

657 |

- |

- |

- |

Heva (22) |

Canada |

100.0% |

1,615 |

- |

0.08 |

- |

- |

- |

- |

136 |

- |

- |

- |

Hosco (22) |

Canada |

100.0% |

14,460 |

- |

0.03 |

- |

- |

- |

- |

461 |

- |

- |

- |

Star (12,23) |

United States |

100.0% |

2,044 |

3.5 |

- |

6.7 |

6.7 |

- |

7,129 |

- |

137,040 |

137,570 |

- |

San Juan Silver (12,25) |

United States |

100.0% |

2,351 |

15.8 |

0.01 |

1.4 |

1.1 |

- |

37,026 |

27 |

47,430 |

38,020 |

- |

Monte Cristo (26) |

United States |

100.0% |

523 |

0.2 |

0.24 |

- |

- |

- |

126 |

101 |

- |

- |

- |

Rock Creek (12,27) |

United States |

100.0% |

99,997 |

1.5 |

- |

- |

- |

0.7 |

148,688 |

- |

- |

- |

658,410 |

Libby Exploration Project (12,28) |

United States |

100.0% |

112,185 |

1.6 |

- |

- |

- |

0.7 |

183,346 |

- |

- |

- |

759,420 |

Rackla - Tiger Open Pit (29) |

Canada |

100.0% |

30 |

- |

0.05 |

- |

- |

- |

- |

2 |

- |

- |

- |

Rackla - Tiger Underground(29) |

Canada |

100.0% |

153 |

- |

0.07 |

- |

- |

- |

- |

11 |

- |

- |

- |

Rackla - Osiris Open Pit (30) |

Canada |

100.0% |

5,919 |

- |

0.09 |

- |

- |

- |

- |

529 |

- |

- |

- |

Rackla - Osiris Underground(30) |

Canada |

100.0% |

4,398 |

- |

0.12 |

- |

- |

- |

- |

515 |

- |

- |

- |

Total |

|

|

333,808 |

|

|

|

|

|

492,338 |

6,171 |

553,620 |

470,780 |

1,420,920 |

Note: All estimates are in-situ except for the proven reserves at Greens Creek and Keno Hill which are in surface stockpiles. Stockpile materials make up 26.5 k tons of the total proven reserves at Casa Berardi. Mineral resources are exclusive of reserves. |

|||||||||||||

(8) |

The term "mineral resources" means a concentration or occurrence of material of economic interest in or on the Earth's crust in such form, grade or quality, and quantity that there are reasonable prospects for economic extraction. |

|

|

A mineral resource is a reasonable estimate of mineralization, taking into account relevant factors such as cut-off grade, likely mining dimensions, location or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or in part, become economically extractable. It is not merely an inventory of all mineralization drilled or sampled. |

|

(9) |

The term "measured resources" means that part of a mineral resource for which quantity and grade or quality are estimated on the basis of conclusive geological evidence and sampling. The level of geological certainty associated with a measured mineral resource is sufficient to allow a qualified person to apply modifying factors in sufficient detail to support detailed mine planning and final evaluation of the economic viability of the deposit. |

|

|

Because a measured mineral resource has a higher level of confidence than the level of confidence of either an indicated mineral resource or an inferred mineral resource, a measured mineral resource may be converted to a proven mineral reserve or to a probable mineral reserve. |

|

(10) |

The term "indicated resources" means that part of a mineral resource for which quantity and grade or quality are estimated on the basis of adequate geological evidence and sampling. The level of geological certainty associated with an indicated mineral resource is sufficient to allow a qualified person to apply modifying factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Because an indicated mineral resource has a lower confidence level than a measured mineral resource, an indicated mineral resource may only be converted to a probable mineral reserve. |

|

(11) |

The term "inferred resources" means that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. The level of geological uncertainty associated with an inferred mineral resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. Because an inferred mineral resource has the lowest level of geological confidence of all mineral resources, which prevents the application of the modifying factors in a manner useful for evaluation of economic viability, an inferred mineral resource may not be considered when assessing the economic viability of a mining project and may not be converted to a mineral reserve. |

|

(12) |

Mineral resources are based on $2000/oz gold, $24/oz silver, $1.15/lb lead, $1.35/lb zinc and $4.00/lb copper, unless otherwise stated. |

|

(13) |

The resource NSR cut-off values for Greens Creek are $230/ton for all zones; metallurgical recoveries (actual 2024): 79% for silver, 72% for gold, 81% for lead, and 89% for zinc. |

|

(14) |

The resource NSR cut-off value for Lucky Friday is $236/ton; metallurgical recoveries (actual 2024): 94% for silver, 94% for lead, and 86% for zinc |

|

(15) |

The average resource cut-off grades at Casa Berardi are 0.11 oz/ton gold (3.7 g/tonne) for underground and 0.03 oz/ton gold (1.05 g/tonne) for open pit; metallurgical recovery (actual 2024): 85% for gold; US$/CAN$ exchange rate: 1:1.35. |

|

(16) |

The resource NSR cut-off value at Keno Hill is $134.40/ton (CAN$200/tonne); using minimum width of 4.9 feet (1.5m); metallurgical recovery (actual 2024): 97% for silver, 95% for lead, 87% for zinc; US$/CAN$ exchange rate: 1:1.35 |

|

(17) |

Mineral resources for underground zones at San Sebastian reported at a cut-off grade of $158.8/ton ($175/tonne), open pit resources reported at a cut-off grade of $72.6/ton ($80/tonne); |

|

|

Metallurgical recoveries based on grade dependent recovery curves: recoveries at the mean resource grade average 89% for silver and 84% for gold for oxide material and 85% for silver, 83% for gold, 81% for lead, 86% for zinc, and 83% for copper for sulfide material. |

|

|

Resources reported at a minimum mining width of 8.2 feet (2.5m) for Middle Vein, North Vein, and East Francine, 6.5ft (1.98m) for El Toro, El Bronco, and El Tigre, and 4.9 feet (1.5 m) for Hugh Zone and Andrea. |

|

(18) |

Mineral resources for Fire Creek, Hollister and Midas are reported using a minimum mining width of four feet or the vein true thickness plus two feet, whichever is greater. |

|

(19) |

Fire Creek underground mineral resources are reported at a gold equivalent cut-off grade of 0.22 oz/ton. Metallurgical recoveries: 90% for gold and 70% for silver. |

|

(20) |

Hollister mineral resources, including the Hatter Graben are reported at a gold equivalent cut-off grade of 0.21 oz/ton. Metallurgical recoveries: 88% for gold and 66% for silver |

|

(21) |

Midas mineral resources are reported at a gold equivalent cut-off grade of 0.20 oz/ton. Metallurgical recoveries: 90% for gold and 70% for silver. Inferred resources for the Sinter Zone are reported undiluted. |

|

(22) |

Mineral resources at Heva and Hosco are based on a gold cut-off grade of 0.011 oz/ton (0.37 g/tonnes) for open pit and 0.117 oz/ton (4 g/tonne) for underground and metallurgical recoveries of 95% for gold at Heva and 81.5% and 87.7% for gold at Hosco depending on zone. |

|

|

Heva and Hosco resources are diluted 20% and reported using a 7% mining loss. |

|

(23) |

Indicated and Inferred resources at the Star property are reported using a minimum mining width of 4.3 feet and an NSR cut-off value of $200/ton; Metallurgical recovery: 93% for silver, 93% for lead, and 87% for zinc. |

|

(24) |

Inferred open-pit resources for Fire Creek calculated November 30, 2017, using gold and silver recoveries of 65% and 30% for oxide material and 60% and 25% for mixed oxide-sulfide material. Indicated Resources reclassified as Inferred in 2019. |

|

|

Open pit resources are calculated at $1400 gold and $19.83 silver and cut-off grade of 0.01 Au Equivalent oz/ton and is inclusive of 10% mining dilution and 5% ore loss. Open pit mineral resources exclusive of underground mineral resources. |

|

|

NI43-101 Technical Report for the Fire Creek Project, Lander County, Nevada; Effective Date March 31, 2018; prepared by Practical Mining LLC, Mark Odell, P.E. for Hecla Mining Company, June 28, 2018. |

|

(25) |

Inferred resources reported at a minimum mining width of 6.0 feet for Bulldog and an NSR cut-off value of $200/ton and 5.0 feet for Equity and North Amethyst veins at an NSR cut-off value of $175/ton; Metallurgical recoveries based on grade dependent recovery curves; metal recoveries at the mean resource grade average 89% silver, 74% lead, and 81% zinc for the Bulldog and a constant 85% gold and 85% silver for North Amethyst and Equity. |

|

(26) |

Inferred resource at Monte Cristo reported at a minimum mining width of 5.0 feet and a 0.10 oz/ton gold cut-off grade. Metallurgical recovery: 90% for gold and 90% silver. |

|

(27) |

Inferred resource at Rock Creek reported at a minimum thickness of 15 feet and an NSR cut-off value of $31.50/ton; Metallurgical recoveries: 88% for silver and 92% for copper. |

|

|

Resources adjusted based on mining restrictions as defined by U.S. Forest Service, Kootenai National Forest in the June 2003 'Record of Decision, Rock Creek Project'. |

|

(28) |

Inferred resource at Libby reported at a minimum thickness of 15 feet and an NSR cut-off value of $31.50/ton NSR; Metallurgical recoveries: 88% for silver and 92% copper. |

|

|

Resources adjusted based on mining restrictions as defined by U.S. Forest Service, Kootenai National Forest, Montana DEQ in December 2015 'Joint Final EIS, Montanore Project' and the February 2016 U.S Forest Service - Kootenai National Forest 'Record of Decision, Montanore Project'. |

|

(29) |

Mineral resources at the Rackla-Tiger Project are based on a gold price of $1650/oz, metallurgical recovery of 95% for gold, and cut-off grades of 0.02 oz/ton gold for the open pit portion of the resources and 0.04 oz/ton gold for the underground portions of the resources; US$/CAN$ exchange rate: 1:1.3. |

|

(30) |

Mineral resources at the Rackla-Osiris Project are based on a gold price of $1850/oz, metallurgical recovery of 83% for gold, and cut-off grades of 0.03 oz/ton gold for the open pit portion of the resources and 0.06 oz/ton gold for the underground portions of the resources; US$/CAN$ exchange rate: 1:1.3. |

|

|

||

Totals may not represent the sum of parts due to rounding. |

||

Table B Assay Results – Q4 2024 |

|||||||||||

Keno Hill (Yukon) |

Zone |

Drillhole Number |

Drillhole Azm/Dip |

Sample From (feet) |

Sample To (feet) |

True Width (feet) |

Silver (oz/ton) |

Gold (oz/ton) |

Lead (%) |

Zinc (%) |

Depth From Surface (feet) |

Underground

|

Bermingham - Main Vein |

BMUG24-154 |

107/-17 |

765.5 |

787.5 |

7.5 |

23.8 |

0.00 |

2.9 |

0.9 |

1283 |

Bermingham - Main Vein |

Including |

765.5 |

777.6 |

4.1 |

36.9 |

0.01 |

3.7 |

0.8 |

1283 |

||

Bermingham - Main Vein |

Including |

786.9 |

787.5 |

0.2 |

133.9 |

0.01 |

35.0 |

12.4 |

1283 |

||

Bermingham - Main Vein |

BMUG24-159 |

125/-15 |

641.4 |

652.2 |

6.8 |

42.8 |

0.01 |

9.3 |

9.7 |

1207 |

|

Bermingham - Main Vein |

Including |

643.0 |

652.2 |

5.8 |

49.5 |

0.01 |

10.9 |

9.3 |

1207 |

||

Bermingham - Footwall Vein |

BMUG24-149 |

126/-5 |

450.1 |

451.8 |

1.5 |

35.0 |

0.00 |

4.9 |

0.5 |

1083 |

|

Bermingham - Footwall Vein |

BMUG24-153 |

144/-11 |

459.6 |

479.7 |

16.8 |

7.0 |

0.00 |

0.9 |

0.7 |

1138 |

|

Bermingham - Footwall Vein |

Including |

459.6 |

462.4 |

2.3 |

35.0 |

0.01 |

4.6 |

1.9 |

1138 |

||

Bermingham - Footwall Vein |

BMUG24-154 |

107/-17 |

529.4 |

540.2 |

10.3 |

13.7 |

0.00 |

1.1 |

1.8 |

1198 |

|

Bermingham - Footwall Vein |

Including |

529.4 |

531.8 |

2.2 |

27.9 |

0.00 |

0.6 |

4.5 |

1198 |

||

Bermingham - Footwall Vein |

BMUG24-157 |

112/-15 |

528.8 |

551.8 |

14.2 |

5.8 |

0.00 |

1.0 |

1.3 |

1175 |

|

Bermingham - Footwall Vein |

Including |

528.8 |

529.3 |

0.3 |

43.2 |

0.00 |

18.7 |

3.9 |

1175 |

||

Bermingham - Footwall Vein |

Including |

546.3 |

547.6 |

0.8 |

45.6 |

0.01 |

4.7 |

5.4 |

1175 |

||

Bermingham - Footwall Vein |

BMUG24-158 |

116/-17 |

559.1 |

563.3 |

2.8 |

32.4 |

0.01 |

5.6 |

0.7 |

1201 |

|

Bermingham - Footwall Vein |

Including |

559.1 |

559.9 |

0.5 |

171.5 |

0.02 |

30.6 |

3.3 |

1201 |

||

Bermingham - Footwall Vein |

BMUG24-159 |

125/-15 |

481.6 |

497.0 |

12.5 |

37.3 |

0.00 |

4.8 |

1.2 |

1158 |

|

Bermingham - Footwall Vein |

Including |

492.5 |

493.6 |

0.9 |

117.2 |

0.01 |

15.9 |

10.2 |

1158 |

||

Bermingham - Footwall Vein |

BMUG24-160 |

130/-14 |

479.7 |

493.4 |

11.2 |

36.6 |

0.00 |

3.0 |

0.9 |

1188 |

|

Bermingham - Footwall Vein |

Including |

481.8 |

491.7 |

8.1 |

48.4 |

0.01 |

3.7 |

1.0 |

1188 |

||

Bermingham - Bear Vein |

BMUG24-151 |

138/-11 |

364.5 |

373.7 |

5.7 |

12.6 |

0.01 |

1.9 |

0.1 |

1099 |

|

Bermingham - Bear Vein |

Including |

364.5 |

366.8 |

1.4 |

44.9 |

0.01 |

6.6 |

0.1 |

1099 |

||

Bermingham - Bear Vein |

BMUG24-152 |

150/-6 |

328.2 |

339.4 |

7.5 |

13.2 |

0.01 |

2.6 |

0.9 |

1066 |

|

Bermingham - Bear Vein |

Including |

328.2 |

330.5 |

1.5 |

38.1 |

0.00 |

6.0 |

1.1 |

1066 |

||

Bermingham - Bear Vein |

Including |

338.3 |

339.4 |

0.8 |

42.1 |

0.02 |

8.1 |

6.0 |

1066 |

||

Bermingham - Bear Vein |

BMUG24-154 |

107/-17 |

375.0 |

377.0 |

0.9 |

4.2 |

0.00 |

0.7 |

0.0 |

1168 |

|

Surface

|

Elsa 17- Dixie Vein |

K-24-0900 |

356/-53 |

867.8 |

868.7 |

0.5 |

0.5 |

0.00 |

0.0 |

1.5 |

526 |

Elsa 17- Dixie Vein |

K-24-0901 |

351/-76 |

1424.6 |

1428.6 |

2.6 |

7.8 |

0.00 |

0.8 |

3.3 |

1280 |

|

Elsa 17- Dixie Vein |

K-24-0902 |

316/-65 |

1624.5 |

1631.2 |

6.0 |

0.1 |

0.00 |

0.0 |

0.0 |

1171 |

|

Elsa 17- Dixie Vein |

K-24-0906 |

246/-69 |

1191.1 |

1192.6 |

1.0 |

0.9 |

0.00 |

0.1 |

0.1 |

1027 |

|

Elsa 17- Dixie Vein |

K-24-0907 |

314/-74 |

1316.9 |

1317.9 |

0.7 |

0.3 |

0.00 |

0.0 |

0.0 |

1174 |

|

Elsa 17- Dixie Vein |

K-24-0915 |

264/-69 |

378.9 |

384.4 |

3.9 |

0.1 |

0.00 |

0.0 |

0.0 |

331 |

|

Elsa 17- Dixie Vein |

K-24-0917 |

345/-55 |

429.3 |

442.4 |

9.9 |

0.1 |

0.00 |

0.0 |

0.0 |

296 |

|

Elsa 17 - Ruby Vein |

K-24-0906 |

246/-69 |

761.6 |

763.1 |

0.6 |

1.9 |

0.00 |

0.0 |

0.0 |

664 |

|

Elsa 17 - Ruby Vein |

K-24-0907 |

314/-74 |

1222.2 |

1227.4 |

3.4 |

0.8 |

0.00 |

0.1 |

0.3 |

1099 |

|

Bermingham Deep - Ruby Vein |

K-24-0903 |

280/-63 |

3294.6 |

3294.9 |

0.3 |

41.6 |

0.06 |

0.0 |

0.0 |

2734 |

|

Bermingham Deep - Unknown Vein |

K-24-0904 |

280/-63 |

2524.2 |

2526.0 |

1.7 |

3.2 |

0.00 |

1.3 |

0.9 |

2145 |

|

Bermingham Deep - Chance Vein |

K-24-0913 |

279/-66 |

775.5 |

777.1 |

1.1 |

21.1 |

0.00 |

4.0 |

3.1 |

700 |

|

Bermingham Deep - Main Vein |

K-24-0924 |

292/-68 |

1872.2 |

1873.7 |

1.3 |

54.4 |

0.01 |

3.3 |

1.6 |

1663 |

|

Bermingham Deep - Footwall Vein |

K-24-0903 |

280/-63 |

3500.3 |

3506.6 |

4.8 |

0.1 |

0.00 |

0.1 |

0.1 |

2857 |

|

Bermingham Deep - Footwall Vein |

K-24-0904 |

280/-63 |

2594.7 |

2603.8 |

7.5 |

0.2 |

0.01 |

0.0 |

0.0 |

2202 |

|

Bermingham Deep - Footwall Vein |

K-24-0913 |

279/-66 |

3110.2 |

3120.4 |

7.6 |

0.8 |

0.00 |

0.3 |

0.8 |

2678 |

|

Bermingham Deep - Footwall Vein |

K-24-0924 |

292/-68 |

1954.1 |

1967.8 |

11.3 |

11.1 |

0.00 |

0.5 |

0.5 |

1739 |

|

Bermingham Deep - Footwall Vein |

Including |

1959.0 |

1967.8 |

7.3 |

14.2 |

0.00 |

0.6 |

0.6 |

1739 |

||

Hector Calumet - Ruby Vein |

K-24-0909 |

316/-63 |

2123.1 |

2124.3 |

1.2 |

0.1 |

0.00 |

0.0 |

0.0 |

1773 |

|

Hector Calumet - Ruby Vein |

K-24-0911 |

326/-59 |

2387.1 |

2388.5 |

1.2 |

0.3 |

0.00 |

0.1 |

0.1 |

2082 |

|

Inca - Inca Vein |

K-24-0908 |

150/-90 |

144.4 |

144.9 |

0.3 |

0.2 |

0.00 |

0.0 |

0.1 |

143 |

|

Inca - Inca Vein |

K-24-0910 |

332/-55 |

329.5 |

331.6 |

1.8 |

0.5 |

0.00 |

0.0 |

0.3 |

227 |

|

Inca - Inca Vein |

K-24-0912 |

221/-68 |

417.5 |

452.9 |

22.3 |

18.1 |

0.01 |

2.3 |

16.1 |

394 |

|

Inca - Inca Vein |

Including |

425.0 |

447.8 |

14.3 |

26.1 |

0.02 |

2.8 |

20.9 |

401 |

||

Inca - Inca Vein |

K-24-0914 |

352/-58 |

600.7 |

603.3 |

1.9 |

1.0 |

0.01 |

0.1 |

0.2 |

531 |

|

Inca - Inca Vein |

K-24-0918 |

262/-69 |

498.7 |

503.6 |

3.9 |

25.7 |

0.02 |

0.6 |

0.7 |

934 |

|

Inca - Inca Vein |

Including |

499.7 |

500.6 |

0.6 |

89.2 |

0.06 |

2.4 |

0.4 |

934 |

||

|

|

||||||||||

|

|

||||||||||

Greens Creek (Alaska) |

Zone |

Drillhole Number |

Drillhole Azm/Dip |

Sample From (feet) |

Sample To (feet) |

True Width (feet) |

Silver (oz/ton) |

Gold (oz/ton) |

Lead (%) |

Zinc (%) |

Depth From Mine Portal (feet) |

Underground

|

5250 |

GC-6484 |

47/-56 |

198.3 |

202.4 |

3.8 |

4.3 |

0.01 |

6.7 |

11.5 |

-73 |

5250 |

GC-6484 |

47/-56 |

272.7 |

297.2 |

24.3 |

29.7 |

0.08 |

3.4 |

4.4 |

-151 |

|

5250 |

GC-6512 |

65/-65 |

186.9 |

191.0 |

4.1 |

2.1 |

0.01 |

7.6 |

9.8 |

-63 |

|

5250 |

GC-6533 |

88/-26 |

48.0 |

71.9 |

15.6 |

17.2 |

0.04 |

3.2 |

7.4 |

-15 |

|

5250 |

GC-6533 |

88/-26 |

77.0 |

134.0 |

46.6 |

24.3 |

0.07 |

4.3 |

9.2 |

-44 |

|

5250 |

GC-6538 |

64/-41 |

35.3 |

47.2 |

11.8 |

4.2 |

0.03 |

8.6 |

22.7 |

-33 |

|

5250 |

GC-6539 |

64/-19 |

48.7 |

64.0 |

14.2 |

5.1 |

0.03 |

8.3 |

17.6 |

-15 |

|

5250 |

GC-6541 |

80/-12 |

30.1 |

41.3 |

8.8 |

1.7 |

0.01 |

6.5 |

12.6 |

-10 |

|

5250 |

GC-6541 |

80/-12 |

67.8 |

81.3 |

6.6 |

27.6 |

0.15 |

9.2 |

27.0 |

-19 |

|

5250 |

GC-6543 |

64/-57 |

145.3 |

156.2 |

9.1 |

16.7 |

0.01 |

1.3 |

2.7 |

-129 |

|

9A |

GC-6559 |

64/-17 |

107.2 |

118.8 |

11.0 |

11.1 |

0.07 |

2.0 |

3.9 |

-88 |

|

9A |

GC-6560 |

64/-25 |

72.5 |

76.2 |

3.4 |

14.2 |

0.02 |

3.8 |

11.0 |

-88 |

|

9A |

GC-6560 |

64/-25 |

80.0 |

92.2 |

11.2 |

34.2 |

0.05 |

0.9 |

1.6 |

-94 |

|

9A |

GC-6571 |

73/16 |

248.5 |

267.0 |

17.3 |

10.8 |

0.21 |

4.5 |

8.7 |

-320 |

|

9A |

GC-6573 |

56/7 |

334.7 |

341.0 |

2.2 |

46.8 |

0.23 |

11.2 |

18.6 |

-368 |

|

9A |

GC-6575 |

70/38 |

511.2 |

536.5 |

18.5 |

11.1 |

0.03 |

4.9 |

11.6 |

-93 |

|

9A |

GC-6575 |

70/38 |

546.3 |

551.6 |

3.9 |

26.3 |

0.02 |

8.1 |

13.8 |

-73 |

|

9A |

GC-6575 |

70/38 |

563.8 |

572.3 |

6.2 |

27.4 |

0.03 |

5.8 |

11.5 |

-59 |

|

Gallagher |

GC-6483 |

336/-50 |

76.3 |

79.4 |

3.1 |

67.7 |

0.10 |

3.5 |

8.2 |

-794 |

|

Gallagher |

GC-6497 |

212/-53 |

72.7 |

76.9 |

4.0 |

12.8 |

0.21 |

3.6 |

9.1 |

-798 |

|

Gallagher |

GC-6504 |

295/-32 |

51.3 |

55.5 |

4.1 |

3.0 |

0.09 |

2.4 |

11.8 |

-767 |

|

Gallagher |

GC-6504 |

295/-32 |

64.1 |

68.2 |

4.0 |

6.2 |

0.02 |

4.6 |

11.1 |

-777 |

|

Gallagher |

GC-6505 |

353/-43 |

154.9 |

179.0 |

16.7 |

3.7 |

0.30 |

3.8 |

10.8 |

-840 |

|

Gallagher |

GC-6514 |

20/-37 |

170.0 |

181.1 |

11.1 |

8.0 |

0.15 |

4.7 |

10.4 |

-849 |

|

Gallagher |

GC-6516 |

34/-53 |

153.2 |

157.5 |

3.5 |

6.6 |

0.15 |

3.3 |

9.0 |

-861 |

|

Gallagher |

GC-6524 |

278/-58 |

147.1 |

155.7 |

8.3 |

5.3 |

0.12 |

4.3 |

12.5 |

-859 |

|

West |

GC-6474 |

66/3 |

67.0 |

77.7 |

10.2 |

6.0 |

0.24 |

6.8 |

21.2 |

-482 |

|

West |

GC-6486 |

64/-11 |

670.0 |

678.0 |

8.0 |

40.1 |

0.36 |

4.3 |

8.2 |

-69 |

|

West |

GC-6494 |

60/-8 |

671.1 |

677.4 |

5.3 |

24.6 |

0.17 |

5.4 |

8.9 |

-54 |

|

West |

GC-6508 |

55/-9 |

670.0 |

683.2 |

12.1 |

34.6 |

0.44 |

2.8 |

5.9 |

-62 |

|

West |

GC-6511 |

55/-13 |

666.1 |

684.8 |

18.6 |

19.6 |

0.34 |

1.3 |

2.5 |

-90 |

|

West |

GC-6521 |

52/-6 |

669.9 |

673.0 |

3.1 |

4.9 |

0.22 |

0.3 |

0.6 |

-28 |

|

West |

GC-6521 |

52/-6 |

683.3 |

693.0 |

9.6 |

7.1 |

0.14 |

0.6 |

1.3 |

-29 |

|

|

West |

GC-6542 |

69/-18 |

503.6 |

507.0 |

3.4 |

3.5 |

0.02 |

7.7 |

11.4 |

-156 |

UG Expl |

Upper Plate |

GC-6554 |

270/56 |

261.0 |

264.0 |

2.3 |

15.1 |

0.01 |

3.7 |

8.4 |

263 |

Surface

|

Upper Plate |

PS-0486 |

25/-48 |

337.1 |

349.8 |

11.9 |

7.9 |

0.01 |

7.4 |

3.7 |

401 |

Upper Plate |

PS-0486 |

25/-48 |

426.0 |

427.0 |

0.8 |

0.3 |

0.00 |

8.9 |

6.3 |

330 |

|

Upper Plate |

PS-0489 |

273/-73 |

326.0 |

330.4 |

3.7 |

8.5 |

0.04 |

5.4 |

3.3 |

338 |

|

Upper Plate |

PS-0493 |

257/-49 |

291.0 |

292.5 |

1.1 |

0.5 |

0.00 |

20.0 |

5.2 |

288 |

|

Upper Plate |

PS-0500 |

252/-53 |

391.8 |

395.4 |

3.4 |

6.7 |

0.01 |

7.4 |

4.0 |

337 |

|

Mammoth Zone |

PS-0485 |

63/-80 |

11.1 |

14.7 |

3.1 |

1.4 |

0.01 |

0.2 |

0.4 |

2113 |

|

Mammoth Zone |

PS-0491 |

63/75 |

201.5 |

209.8 |

7.6 |

0.5 |

0.11 |

1.0 |

0.4 |

1866 |

|

Mammoth Zone |

PS-0491 |

63/75 |

248.8 |

249.8 |

0.8 |

0.3 |

0.00 |

7.1 |

0.0 |

1824 |

|

Gallagher |

PS-0490 |

270/83 |

3736.4 |

3739.3 |

0.0 |

2.0 |

0.04 |

1.9 |

1.2 |

1641 |

|

View source version on businesswire.com: https://www.businesswire.com/news/home/20250212842244/en/

For further information, please contact:

Anvita M. Patil

Vice President - Investor Relations and Treasurer

Cheryl Turner

Communications Coordinator

Investor Relations

Email: [email protected]

Website: http://www.hecla.com