Impactive Capital Issues Letter to WEX Inc. Shareholders Announcing Its Intention to Vote Against Three Directors at 2025 Annual Meeting

Plans to Vote Against Jack VanWoerkom, Melissa Smith, and James Neary

Confident Company can Deliver Value to All Stakeholders with the Right Leadership and Strategy

NEW YORK, May 02, 2025 (GLOBE NEWSWIRE) -- Impactive Capital, LP, together with its affiliates, one of the largest shareholders of WEX Inc. (NYSE:WEX) (the "Company") with an ownership interest of approximately 7.0% today issued an open letter to the Company's shareholders.

The full text of the letter is set forth below:

Dear Fellow Shareholders,

Impactive Capital LP (together with its affiliates, "Impactive" or "we") is a large and longstanding shareholder of WEX Inc. ("WEX" or the "Company"), beneficially owning approximately 7.0% of the shares outstanding. As one of WEX's largest and most committed shareholders — our ownership position is more than five times that of the entire board of directors (the "Board") and executive officers combined— we are deeply invested in the Company's long-term success. We believe that with the right change and improved shareholder alignment, WEX can deliver significant value to all stakeholders.

As further detailed below, we have privately and constructively engaged with the Board and management for the past four years. At the end of 2024 and after a period of deteriorating performance, we requested that an Impactive representative be added to the Board to bring a much-needed shareholder perspective. Unfortunately, the Board and management have seemingly ignored our feedback and refused to act with sufficient urgency to address the ongoing issues at the Company.

Accordingly, we have determined that it is necessary to vote AGAINST three incumbent directors — Jack VanWoerkom, Melissa Smith, and James Neary — to send a clear message that refreshed Board representation, including a shareholder voice, is urgently needed. We believe this is the only meaningful way for us as a large shareholder to demand necessary change at WEX.

A Business with Strong Foundations and Untapped Potential

Our WEX investment in 2021 was grounded in a conviction that WEX has strong market positioning, attractive assets, pricing power, and durable competitive advantages. We continue to firmly believe in WEX's core strengths and long-term potential.

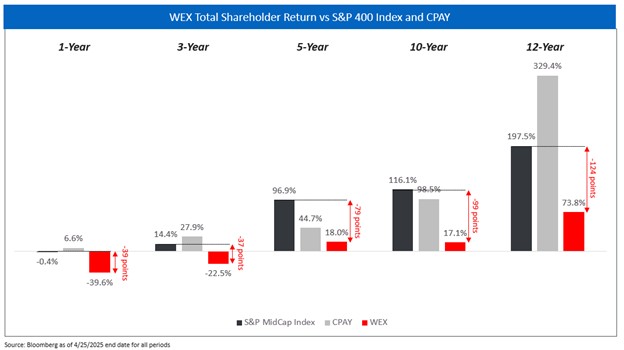

However, the gap between WEX's intrinsic value and its stock price performance has widened materially over time. Over the past 12 years, WEX has underperformed both its closest peer, Corpay, Inc. ("CPAY"), by over 250 percentage points and the S&P 400 by over 120 percentage points. Both WEX and CPAY began this period with similar assets and positioning, suggesting that the growing divergence is evidence of inferior capital allocation, operational performance, and strategic oversight. The performance gap between WEX and CPAY has only widened in the last year, when WEX's shareholder returns have trailed CPAY by over 40 points. Despite these troubling results, the Board has proposed no changes to its composition and refused to allow real shareholder representation in its ranks. This underperformance underscores why we are taking a stand against the status quo at this year's annual meeting.

Our Approach: Constructive Engagement

For the past four years, and with greater urgency over the past twelve months, we have sought to engage constructively with the Board. We have shared detailed proposals to enhance corporate governance, optimize capital allocation, simplify the business, and improve operations.

Last year, in the spirit of collaboration, we requested one Board seat for an Impactive representative. We viewed this as a modest and proportionate step to strengthen alignment between the Board and WEX's long-term investors. Disappointingly, the Board has thus far dismissed this reasonable request— not only from us but from other concerned shareholders who have independently reached out in support of adding Impactive's voice to the Board.

Our Plan

We believe the Company is at a critical juncture and change is desperately needed to improve its current trajectory. Accordingly, at this year's annual meeting, we intend to vote AGAINST three directors who have presided over long-term underperformance:

- Jack VanWoerkom, Lead Independent Director, whose two-decade tenure will be further extended only because the Company changed its longstanding age limit policy the very year Mr. VanWoerkom would exceed it.

- Melissa Smith, CEO and Chairwoman, to encourage, in line with corporate governance best practices, that there is a separation of roles, which we believe would lead to enhanced Board oversight and strengthened CEO accountability.

- James Neary, Director, who has served on the Board for nearly a decade and was initially appointed to represent a large shareholder that exited its position three years ago. The Board should reflect current ownership and alignment, and certainly not prioritize "holdover" directors at the expense of its current shareholders.

While we respect the service these individuals have provided, fresh perspectives and stronger shareholder representation are urgently needed to mitigate the risks of entrenchment and set WEX on the right path to restore investor confidence. We are voting AGAINST these directors as a referendum on the Board to demand accountability and send the message that meaningful change is necessary.

Looking Ahead

While our engagement to date has not resulted in the progress we had hoped for, we remain committed to working productively and collaboratively with the Board and management to help WEX achieve its full potential. We continue to believe that shareholder representation in the boardroom is essential to restoring investor confidence and unlocking value. We strongly encourage the Board to reconsider our request to add an Impactive representative to the Board to pursue value-maximizing initiatives and better reflect the Company's ownership base. However, should the Board continue to rebuff us, we must reserve our rights to take any action that we believe necessary to protect shareholder interests, including nominating directors at next year's annual meeting.

We look forward to continuing to share our thoughts with our fellow WEX shareholders.

Thank you,

Impactive Capital

Contact:

[email protected]

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/a4453b1f-4d6e-4c63-b2ce-ff330bd50630