Last Energy Announces Oversubscribed $100 Million Series C

Financing Round Secures Capital For Pilot Reactor And Positions Company For First Deployment

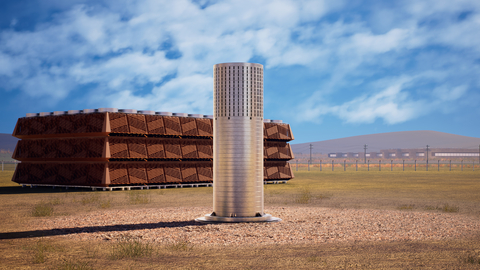

Conceptual rendering of Last Energy's PWR-20

Last Energy, an advanced nuclear technology company, today announced it has closed an oversubscribed Series C of more than $100 million led by the Astera Institute, with participation from JAM Fund, Gigafund, The Haskell Company, AE Ventures, Ultranative, Galaxy Interactive, and Woori Technology Co., Ltd., among others.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20251216381143/en/

Conceptual rendering of Last Energy's PWR-20

"We believe this financing will fully capitalize us through our DOE pilot project and position us to transition into commercialization of our production power plants," said Bret Kugelmass, Founder and CEO of Last Energy. "A new nuclear era is underway, and we intend to showcase how factory fabrication will unlock the scalability that the energy market demands."

Following this round, Last Energy is focusing on completing its PWR-5 pilot reactor, advancing PWR-20 commercialization, and strengthening its footprint in Texas through expanded investment in manufacturing capabilities and partner engagement.

"Astera exists to support ambitious teams exploring ideas with transformative potential. Last Energy is applying a product mindset to nuclear energy that could reshape power generation," said Jed McCaleb, Co-Founder of the Astera Institute. "We're proud to support their work because this early, high-conviction approach can unlock new opportunity spaces in energy."

Last Energy is operating at the forefront of new nuclear deployment, advancing projects through both U.S. and UK regulatory pathways. In August 2025, the company was selected for the U.S. Department of Energy's (DOE) Reactor Pilot Program and, leveraging a previously procured full core load of fuel, secured a lease at the Texas A&M–RELLIS Campus and signed the first known Other Transaction Agreement (OTA) between the DOE and a reactor developer, in preparation for an anticipated 2026 criticality demonstration. In the United Kingdom, Last Energy has completed a Preliminary Design Review and is the only known company with a regulator-confirmed pathway toward a potential 2027 site license decision, further supported by its recognition in the Atlantic Partnership for Advanced Nuclear Energy.

"Ensuring steady access to clean power is critical to enabling the next wave of industrial and economic growth," said Sam Englebardt, GP at Galaxy Interactive, a venture platform within Galaxy Digital Inc. (NASDAQ:GLXY). "We believe Last Energy is well-positioned to deliver on this moment with a pragmatic yet revolutionary solution to nuclear deployment, built around one of the most capital-efficient approaches we've seen. Their micro-modular reactors aim to offer a pathway to providing meaningful new energy capacity in the settings that need it most."

At the core of Last Energy's approach is a fully integrated, hermetic steel containment built around proven pressurized water technology and off-the-shelf fuel, transforming its nuclear steam supply system into a supply-chain-ready, factory-manufacturable product. This productized approach has driven one of the industry's largest commercial microreactor pipelines, with traction in both electric and heat-only applications with data center and industrial customers, positioning the company to scale its technology internationally.

NOTES TO EDITORS

This press release includes forward-looking statements, including Last Energy's expectations, hopes, beliefs, intentions or strategies regarding the future. Forward-looking statements may be identified by the use of words such as "anticipate," "believe," "continue," "could," "estimate," "forecast," "intend," "expect," "may," "plan," "potential," "project," "seek," "should," "will," "would" and similar expressions that predict or indicate future events or trends or that are not statements of historical matters, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements include, but are not limited to, statements regarding: the use of proceeds from the Series C financing, the ability of Last Energy to fully capitalize its DOE pilot project and transition to commercialization, Last Energy's ability to scale, Last Energy's ability to complete its PWR-5 pilot program on the expected timeline or at all, advance its PWR-20 commercialization and expand its operational footprint, and Last Energy's ability to maintain and grow its customer pipeline and to deliver a commercial product on terms acceptable to customers. These statements are based on various assumptions, whether or not identified in this press release, and on the current expectations of Last Energy's management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied upon as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond Last Energy's control. These forward-looking statements are subject to a number of risks and uncertainties, including changes in business, market, cannibal, political and legal conditions; risks related to the development of Last Energy's products on the expected timeline for such development efforts; the effects of competition on Last Energy's business; and risks related to working with third-party manufacturers. If any of these or other risks materialize or any assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. The forward-looking statements included in this press release speak as of the date of this press release.

About Last Energy:

- Last Energy is a pioneering US technology company focused on the fleet-scale deployment and operation of next-generation nuclear assets. With one of the industry's largest commercial microreactor pipelines, the company aims to locate its proprietary 20 MWe microreactor in strategic clusters near AI data centers and industrial facilities.

- By integrating all primary systems into a single, hermetic containment built around proven PWR technology, Last Energy's reactor is engineered for high-throughput manufacturability, leveraging existing supply chains.

- With a rapidly expanding pipeline of microreactor projects across the U.S., UK, and Europe, Last Energy is preparing for international power delivery. The company is also a leading participant in the DOE's New Reactor Pilot Program, which targets a criticality test in 2026.

View source version on businesswire.com: https://www.businesswire.com/news/home/20251216381143/en/

Jacob Jimenez | [email protected]