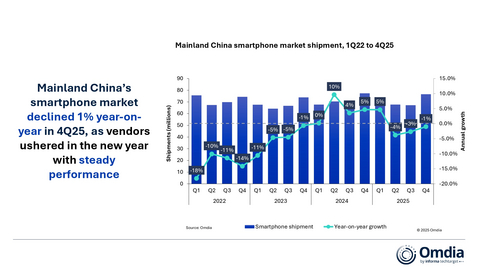

Omdia: Mainland China's Smartphone Market Declined 1% in 2025 as Huawei Reclaimed the Top Spot After Five Years

According to Omdia's latest research, mainland China's smartphone market declined 1% year on year in 2025, and full-year shipments reached 282.3 million units. With a shipment of 46.8 million units, Huawei returned to the top spot, accounting for a 17% market share. vivo closely followed in second place with 46.0 million units shipped and a 16% market share. Benefiting from its strong performance in the fourth quarter, Apple maintained its position in the top three with an annual shipment volume of 45.9 million units. Xiaomi shipped 43.7 million units and OPPO 42.8 million units, securing the fourth and fifth positions respectively.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20260115728535/en/

Mainland China smartphone market shipment, 1Q22 to 4Q25

In 4Q25, driven by year-end promotions and the continuation of national subsidy policies, the overall market decline moderated. The mainland China smartphone market posted a 1% year-on-year decrease in the fourth quarter, with shipments reaching 76.4 million units. Apple led the market with 16.5 million units shipped in 4Q25, accounting for a 22% market share. vivo ranked second with 11.9 million units and a 16% market share. OPPO's market performance rebounded, with shipments reaching 11.6 million units, rising two positions year-on-year in the top three. Huawei shipped 11.1 million units to rank fourth, closely followed by Xiaomi with 10.0 million units shipped.

"Apple achieved solid shipment growth by leveraging a product differentiation and upgrade strategy, supporting overall volumes while refining its portfolio. In addition to strong consumer reception for the redesigned iPhone 17 Pro series, the iPhone 17 features comprehensive upgrades to storage and display specifications while maintaining the same entry-level pricing as its predecessor. Its contribution within the product mix has surpassed that of previous base models. " Hayden Hou, Principal Analyst at Omdia, commented: "Local brands are steadily advancing their premiumization strategies. Huawei has increased its investment in HarmonyOS and carried out a comprehensive upgrade, launching HarmonyOS 6 in October and committing RMB 1 billion to support innovation in the HarmonyOS and AI ecosystem. Xiaomi brought forward the launch of its flagship Xiaomi 17 Ultra to December, releasing the device ahead of its competitors' new product rollouts.

Lucas Zhong, Analyst at Omdia, said: "As we predicted at the start of the year 2025, the impact of national subsidy policies on the market is mainly reflected in pulling demand forward rather than generating organic growth. Due to inconsistencies in national subsidies in the second and third quarters, the market experienced an adjustment period. However, based on the practices implemented in 2025, all brands, including Apple, have completed their deployments by restructuring product portfolios and adjusting pricing strategies. Channel partners have gained valuable experience over the past year and established operational processes. Along with the year-end and upcoming national subsidy policies, this provides a stable and positive foundation for market development in 2026."

Hou added: "In 2026, rising costs will become a major challenge for smartphone vendors in both mainland China and global markets. Rising memory costs are creating a highly dynamic environment for component supply, product strategy, and pricing strategy, compelling vendors to strategically balance cost allocation, price competitiveness, and hardware upgrade paths."

Hou continued: "Despite short-term cost pressures, vendors are sustaining investments in long-term value drivers, including channel enhancements - such as flagship store expansions and renovations - AI and cross-device ecosystem development, and imaging innovation. We expect 2026 to remain a year of value growth and product innovation in Mainland China's smartphone market."

Mainland China's smartphone shipment and annual growth

|

|||||

Vendor |

4Q25

|

4Q25

|

4Q24

|

4Q24

|

Annual

|

Apple |

16.5 |

22% |

13.1 |

17% |

26% |

vivo |

11.9 |

16% |

12.9 |

17% |

-8% |

OPPO |

11.6 |

15% |

10.6 |

14% |

9% |

Huawei |

11.1 |

15% |

12.9 |

17% |

-14% |

Xiaomi |

10.0 |

13% |

12.2 |

16% |

-18% |

Others |

15.3 |

20% |

15.6 |

19% |

-1% |

Total |

76.4 |

100% |

77.4 |

100% |

-1% |

|

|

|

|||

Note: Huawei excludes HONOR since 1Q21. OPPO includes OnePlus. vivo includes iQOO. Percentages may not add up to 100% due to rounding. Source: Omdia Smartphone Horizon Service (sell-in shipments), January 2026 |

|||||

Mainland China's smartphone shipment and annual growth

|

|||||

Vendor |

2025

|

2025

|

2024

|

2024

|

Annual

|

Huawei |

46.8 |

17% |

46.0 |

16% |

2% |

vivo |

46.0 |

16% |

49.3 |

17% |

-7% |

Apple |

45.9 |

16% |

42.9 |

15% |

7% |

Xiaomi |

43.7 |

15% |

41.9 |

15% |

4% |

OPPO |

42.8 |

15% |

42.7 |

15% |

+0% |

Others |

57.2 |

20% |

61.9 |

22% |

-7% |

Total |

282.3 |

100% |

284.6 |

100% |

-1% |

|

|

|

|||

Note: Huawei excludes HONOR since 1Q21. OPPO includes OnePlus. vivo includes iQOO. Percentages may not add up to 100% due to rounding. Source: Omdia Smartphone Horizon Service (sell-in shipments), January 2026 |

|||||

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (NASDAQ:TTGT), is a technology research and advisory group. Our deep knowledge of tech markets grounded in real conversations with industry leaders and hundreds of thousands of data points, make our market intelligence our clients' strategic advantage. From R&D to ROI, we identify the greatest opportunities and move the industry forward.

View source version on businesswire.com: https://www.businesswire.com/news/home/20260115728535/en/

Fasiha Khan – [email protected]