Outerbridge Sends Letter to Comtech Board of Directors

Believes Shareholders Have Lost Confidence in Company's Leadership – As Evidenced by Double-Digit Decline in Share Price after Announcement of Planned Appointment of Michael Porcelain as CEO and Disappointing FY21 Results

Highlights Company's Long-Term Underperformance, Strategic Inattention, and History of Failed M&A Strategy

Remains Open to Constructive Resolution, Despite Comtech's Unfortunate Misrepresentation of Engagement with Outerbridge to Date

Outerbridge Nominees Would Bring Essential Experience and Expertise to Comtech Board and Help Unlock the Company's Substantial Intrinsic Value

Outerbridge Capital Management, LLC ("Outerbridge"), a beneficial owner of approximately 4.95% of Comtech Telecommunications Corp.'s (NASDAQ:CMTL) ("Comtech" or the "Company") outstanding shares of common stock, today sent the following letter to the Company's Board of Directors:

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211006005634/en/

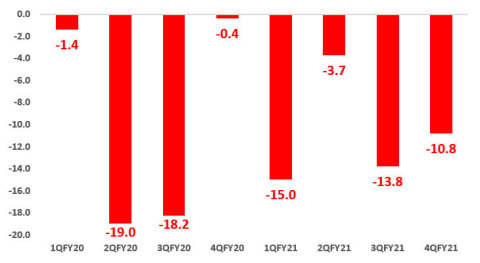

1-day percentage change in Comtech's share price after earnings announcement (Source: FactSet)

October 6, 2021

Board of Directors

Comtech Telecommunications Corp.

68 South Service Road, Suite 230

Melville, New York 11747

Dear Members of the Board:

Outerbridge Capital Management, LLC, together with its affiliates ("Outerbridge" or "we"), beneficially owns approximately 4.95% of Comtech Telecommunications Corp.'s (NASDAQ:CMTL) ("Comtech" or the "Company") outstanding shares of common stock.

As laid out in our letter of June 14, 2021, we believe Comtech is at an important juncture and faces critical decisions about its future direction. The double-digit decline in Comtech's share price in response to the planned appointment of Comtech's President and COO Michael Porcelain as CEO and a disappointing FY21 earnings announcement has again illustrated shareholders' lack of faith in Comtech's management team and its incumbent Board of Directors (the "Board"). This marks the eighth consecutive quarter of a negative market reaction to a Comtech earnings announcement as investors have grown weary of uninspiring results.

Moreover, we believe shareholders should now question the Board's conduct as fiduciaries in having chosen to name Mr. Porcelain as the Company's next CEO. After all, Mr. Porcelain and outgoing CEO Fred Kornberg have failed to create value for Comtech shareholders over the span of not just years, but decades, and, we believe, lack credibility among investors. Prior to his appointment as COO and President, Mr. Porcelain served as Comtech's CFO for twelve years, during which time the Company suffered sharp declines in organic revenues and profits and failed to generate a compelling return from allocated capital.

We also question the timing of and mechanics around this purported "succession plan," which conveniently circumvents the upcoming shareholder vote and allows Messrs. Porcelain and Kornberg to increase their representation on the reconstituted Board.

Finally, Comtech has consistently misled shareholders regarding its engagement with Outerbridge. We initially referred two independent nominees for the Board's consideration on August 9th with the hopes of establishing a constructive dialogue with the Company to resolve concerns around underperformance, strategy, the lack of relevant expertise on the independent Board, financial reporting, and poor governance. However, our repeated efforts to cooperatively engage with the Board in lieu of a public contest were met with an obstinate lack of urgency, continuous delays, and, at times, an open belligerence from Mr. Porcelain himself.

We thus surmised that the Board had no interest in achieving a settlement prior to the September 9th nomination deadline, and accordingly conducted in parallel a formal search with a third party to secure a qualified slate of independent nominees, if necessary, as neither of our privately submitted candidates could be part of an active proxy campaign due to prior commitments. As the independent Board did not respond to any prior requests for interview consideration of our two August nominees until September 7th, it is clear that a formal nomination was warranted.

Despite all this, we remain open to a constructive solution. In the meantime, we urge our fellow shareholders to consider the following:

History of Underperformance

Under the leadership of Fred Kornberg and Michael Porcelain, Comtech returns have lagged the peer median and relevant indices on a 1-, 3-, 5-, and 10-year basis.

Unaffected Total Shareholder Return (TSR) as of June 11, 2011 (One Day Prior to Outerbridge's Letter to the Board) |

||||

1-year |

3-year |

5-year |

10-year |

|

Peer Median |

58.4% |

86.9% |

219.9% |

234.1% |

S&P 500 |

43.7% |

61.2% |

123.1% |

304.4% |

Nasdaq Telecommunications Index |

31.1% |

46.5% |

99.8% |

152.0% |

Comtech Telecommunications Corp. |

32.4% |

(28.2%) |

24.0% |

27.7% |

Peers: Axon Enterprise, Inc. (NASDAQ:AXON), Gilat Satellite Networks Ltd. (NASDAQ:GILT), Kratos Defense & Security Solutions, Inc. (NASDAQ:KTOS), Mercury Systems Inc. (NASDAQ:MRCY), Motorola Solutions, Inc. (NYSE:MSI), ViaSat, Inc. (NASDAQ:VSAT) Source: FactSet |

||||

Disappointing FY21 Results and FY22 Outlook

While Comtech's management may claim to be "incredibly proud of [the Company's] performance during fiscal 2021", the Company's poor financial results belie this boastful rhetoric. Investors should consider the following:

Revenue

- FY21 revenue was 13.4% lower than in FY19 (pre-Covid).

- The mid-point of FY22E revenue guidance is below FY19 actual revenue. Importantly, if achieved, it will represent a meager 7.2% increase from Comtech's revenue five years ago in FY17.

- 1QFY22E revenue of $115M will be the lowest quarterly revenue in the last six years – even lower than what Comtech achieved during the depths of the Covid-19 pandemic.

Adjusted EBITDA

- FY21 Adjusted EBITDA was 18.2% lower than in FY19 (pre-Covid).

- The mid-point of FY22E Adjusted EBITDA guidance is below FY19 Adjusted EBITDA. Importantly, if achieved, it would represent a meager 3.2% increase from Comtech's Adjusted EBITDA five years ago in FY17.

- 1QFY22E Adjusted EBITDA of $3M would be the lowest quarterly Adjusted EBITDA in more than a decade of financial results including the global financial crisis.

Furthermore, shareholders should question Comtech's ability to achieve even these disappointing FY22 targets given the unexpected negative revision to FY21 revenue guidance that was triggered by Comtech's material and undisclosed Afghanistan exposure. The following statements made by management on the FY21 earnings call give ample reason for further pause (emphasis added):

"Q1 of fiscal 2022 is expected to be the lowest quarter of financial performance in fiscal 2022. Based on our current expectations of revenues in our Government Solutions segment, we anticipate virtually no Adjusted EBITDA in our Government Solutions segment in Q1 or Q2.

Additionally, with recent spikes in COVID-19 and supply chain issues, our Commercial Solutions segment is being impacted. These issues are expected to result in lower than typical revenues and Adjusted EBITDA for our Commercial Solutions segment in the first half of the fiscal year, but a strong second half as we deliver on our backlog and new orders that are expected to come in.

Based on what we are seeing, we believe these constraints represent a significant performance headwind and believe that our consolidated Q1 revenues will approximate $115 million, with Adjusted EBITDA in the neighborhood of $3 million.

We are closely monitoring our inventory needs and our supplier base, and we cautiously expect these constraints to ease up during the second half of fiscal 2022. As such, we believe that quarterly results after our Q1 will sequentially improve with Q4 being the peak quarter in 2022 by far."

Strategic Concerns Across All Business Segments

Outerbridge believes Comtech has long suffered from strategic inattention at the Board level across all business segments, which has harmed its operational results and hindered value creation:

Government Solutions Segment

- Comtech expects Government Solutions segment net sales in FY22 to be lower than the amount it achieved in FY21, likely resulting in the lowest organic revenue for this segment in decades.

- After peaking at $314M in FY19 (FY16 - FY21 period), Government Solutions segment revenue declined to $221M in FY21 – down 29.6%. Even compared to FY20 (which was impacted by Covid), segment revenues were down 15.8% yoy, Adjusted EBITDA lower by 36.6%, and Net Income lower by 52.5% yoy in FY21.

- While Comtech has attributed the FY21 revenue decline to U.S. Armed Forces withdrawal from Afghanistan, as noted above, the Company completely failed to communicate this risk exposure to shareholders. This failure to report a material risk and attendant lack of transparency spanned over nine years of earnings calls and SEC filings, in which the Company did not once mention how vulnerable its Government Solutions segment was to Afghanistan. Not surprisingly, when in its FQ3 2021 earnings report the Company negatively revised its revenue guidance due to the U.S. Armed Forces' withdrawal, Comtech's share price fell 13.8%.

Commercial Solutions Segment – Satellite Ground Station Technologies ("Satellite Business")

- We believe the 911 Business's growth has masked troubles in Comtech's Satellite Business, given that Comtech currently combines these two business lines under its Commercial Solutions segment.

- The Satellite Business's revenues appear to have stagnated since at least FY15, when the business accounted for $204M on an organic basis, which then declined to $176M in FY16 and FY17.

- Subsequent to FY17, organic comparisons become difficult due to segment reporting, but the consolidated Commercial Solutions revenues that include the Satellite Business and the 911 Business grew at only a 1-2% CAGR between FY17 and FY21.

- By its own admission, in its Satellite Business Comtech has long harvested its incumbency in legacy SCPC modem technology but has failed to organically develop leading solutions for the faster-growing TDMA market. We believe Comtech's failure to deliver needed innovation has historically contributed to a loss of market share in the Satellite Business.

Commercial Solutions Segment – Public Safety and Location Technologies ("911 Business"): A Compelling Set of Assets Masked by Opaque Financial Reporting

Outerbridge believes the 911 Business, which we estimate contributes between $150 - $200M in annual revenues and $30 - $45M in EBITDA, is Comtech's "crown jewel," thanks to the powerful upgrade cycle underway across the United States for "Enhanced 911" or "NG911." In fact, Outerbridge believes the intrinsic value of this segment alone likely exceeds Comtech's current enterprise value based on comparable public companies:

Company Name |

EV/Sales FY22 |

EV/EBITDA FY22 |

Axon Enterprise, Inc. |

10.6x |

52.9x |

Bandwidth Inc. |

3.9x |

42.4x |

Everbridge, Inc. |

12.4x |

231.9x |

Five9, Inc. |

14.8x |

76.6x |

Motorola Solutions, Inc. |

5.0x |

16.9x |

NICE Ltd. |

8.2x |

24.3x |

ShotSpotter, Inc. |

5.8x |

24.2x |

Peer Median |

8.2x |

42.4x |

Comtech |

1.4x |

10.3x |

Source: FactSet data as of 10/5/2021 |

||

Unfortunately, Comtech has failed to appropriately showcase the 911 Business to investors. Rather than breaking out revenue and EBITDA data for the 911 Business separately, Comtech has chosen to commingle 911 Business results with its Commercial Solutions segment alongside the low margin and slow growth Satellite Business. This has created a situation whereby this segment is currently compared to low margin hardware players like Viasat and Gilat Satellite Networks, rather than high margin public safety and CCaaS players like Motorola Solutions, Axon Enterprise, Everbridge, NICE, and Five9.

History of Failed M&A Strategy

In addition to the strategic failures outlined above, Comtech's Board has continued to green-light an aggressive M&A strategy, despite management's destruction of shareholder value:

In January of 2020, Comtech announced the proposed acquisition of Gilat Satellite Networks for $524 million, triggering a sharp sell-off in the stock and a price drop of nearly 20% in a single day. Shareholders' severely negative reaction to this deal was likely motivated at least in part by management and the Board's poor track record managing prior large, leveraged acquisitions.

Indeed, in November of 2015, about a year after its own review of strategic alternatives was publicly called off, Comtech announced the acquisition of TeleCommunication Systems, Inc. ("TCS") for $430 million. TCS had annual revenues of $365 million and Adjusted EBITDA of $40 million, with Comtech reporting annual revenues of $308 million and Adjusted EBITDA of $52 million. Comtech guided shareholders to expect further synergies of $8 - $12 million from the TCS deal, implying that EBITDA should have reached $100 million or more in the following years, and grown thereafter. Instead, due to organic declines in Comtech's business, annual EBITDA never exceeded $93 million in the five years following the TCS merger, with FY21 EBITDA at just $77 million.

In the aggregate, Comtech has now invested ~$400 million of cash, including the $70 million termination fee paid to Gilat, and issued dilutive equity to pursue a flawed M&A strategy (FY16 - FY21). Despite spending hundreds of millions of dollars and issuing the aforementioned shares, FY21 revenue was only 6% and Adjusted EBITDA 8% higher than in FY17, which was the first full year that incorporated results from the TCS acquisition.

* * *

Outerbridge's Nominees are Uniquely Well-Suited to Address the Deficiencies of the Current Board

Outerbridge believes Comtech's long history of failure is due above all to a Board that is seemingly incapable of overseeing management. While we are encouraged by Comtech's announcement to eliminate the staggered three-year terms for its directors, we do not believe any of the Company's recent governance maneuvers will be able to solve for the Board's lack of relevant experience, independence, and shareholder alignment.

In contrast to Comtech's current directors, Outerbridge's nominees possess ample industry expertise and bring a proven track record of successfully negotiating challenges in service both to corporate owners and to our country:

- Wendi Carpenter completed a distinguished 34-year career in the U.S. Navy before retiring as a Rear Admiral. She was the Commander of the Navy Warfare Development Command (driving key innovation, development, and acquisition in satellites, cyber, communications, and unmanned systems with other USG partners), Deputy Commander of the U.S. Second Fleet, and she held key senior U.S. joint and NATO executive positions. She provided crisis and disaster support to FEMA and HLS, and oversaw the Logistics Crisis Action Center for the Navy following 9/11. Rear Admiral Carpenter currently serves as an Independent Director and Chair of the Compensation Committee of SkyWater Technology, Inc. (NASDAQ:SKYT), a U.S. owned $1.2 billion semiconductor development and manufacturing company with significant classified USG and aerospace communications business.

- Sidney Fuchs currently serves as Chairman of the Board at Eutelsat America Corporation, a subsidiary of Eutelsat SA, a leading Paris-based satellite services and communications provider with over 1.2 billion euros in annual revenue. Previously, he served for eight years as an intelligence officer in the CIA before embarking on a prolific career leading and transforming U.S. Government defense contractors as a CEO and director. Most recently, he was the CEO and a director at MacAulay-Brown, Inc., where he led a highly successful turnaround and exit to Veritas Capital Fund Management, LLC.

- Jonathan Wackrow is currently the Chief Operating Officer of Teneo Risk and serves as the Global Head of Security for Teneo, a CEO advisory firm. Jonathan also serves as a principal in the public safety practice advising senior government leaders and elected officials on law enforcement, public safety technology, and emergency management matters. Additionally, he is an exclusive Law Enforcement Analyst for CNN (Warner Media), providing exclusive on-air analysis of law enforcement, public safety, national security, counterterrorism, and physical security matters. Jonathan spent fourteen years as a Special Agent in the United States Secret Service, serving as a criminal investigator in New York City and as a member of the Presidential Protection Division in Washington, D.C.

Outerbridge strongly believes that Comtech's shareholders deserve a Board with the experience, skill set, and constitution required to provide necessary management oversight and guide the Company to organic revenue and profit growth. Shareholders further deserve a Board with proven transactional ability and strategic business acumen, so that the Company might effectively manage future M&A opportunities that may arise, whether as a buyer or seller. In all respects, we believe our three nominees are ideally qualified to help Comtech navigate the challenges and opportunities that lie ahead, and to finally unlock value for shareholders.

Sincerely,

Rory Wallace

Chief Investment Officer

About Outerbridge Capital Management, LLC

Outerbridge Capital Management, LLC is a New York-based investment adviser that typically invests across the technology and technology-impacted sectors. As part of its investment process, Outerbridge regularly conducts significant due diligence on its portfolio companies and engages constructively with both management teams and boards where appropriate.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Outerbridge Partners, LP ("Outerbridge Partners") and the other Participants (as defined below), intend to file a preliminary proxy statement and accompanying WHITE proxy card with the Securities and Exchange Commission ("SEC") to be used to solicit votes for the election of their slate of highly qualified director nominees at the 2021 annual meeting of stockholders of Comtech Telecommunications Corp., a Delaware corporation (the "Company").

OUTERBRIDGE PARTNERS STRONGLY ADVISES ALL STOCKHOLDERS OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS, INCLUDING A PROXY CARD, AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC'S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS' PROXY SOLICITOR.

The participants in the proxy solicitation are anticipated to be Outerbridge Partners, Outerbridge Partners GP, LLC ("Outerbridge GP"), Outerbridge Bartleby Fund, LP ("Outerbridge Bartleby Fund"), Outerbridge Bartleby GP, LLC ("Outerbridge Bartleby GP"), Outerbridge Capital Management, LLC ("Outerbridge Capital"), Rory Wallace, Wendi B. Carpenter, Sidney E. Fuchs, and Jonathan D. Wackrow (collectively, the "Participants").

As of the date hereof, Outerbridge Partners beneficially owns directly 589,750 shares of common stock, $0.10 par value per share, of the Company (the "Common Stock"), including 520,000 shares underlying certain call options currently exercisable. Outerbridge GP, as the general partner of Outerbridge Partners, may be deemed to beneficially own the 589,750 shares of Common Stock directly owned by Outerbridge Partners. Outerbridge Bartleby Fund beneficially owns directly 43,200 shares of Common Stock. Outerbridge Bartleby GP, as the general partner of Outerbridge Bartleby Fund, may be deemed to beneficially own the 43,200 shares of Common Stock directly owned by Outerbridge Bartleby Fund. Outerbridge Capital, as the investment manager of Outerbridge Partners, Outerbridge Bartleby Fund, and certain managed accounts (the "Accounts"), may be deemed to beneficially own the 589,750 shares of Common Stock directly owned by Outerbridge Partners, the 43,200 shares of Common Stock directly owned by Outerbridge Bartleby Fund, and the 671,080 shares of Common Stock held in the Accounts. Mr. Wallace, as the managing member of Outerbridge Capital, Outerbridge GP, and Outerbridge Bartleby GP, may be deemed to beneficially own the 589,750 shares of Common Stock directly owned by Outerbridge Partners, the 43,200 shares of Common Stock directly owned by Outerbridge Bartleby Fund, and an additional 671,080 shares of Common Stock held in the Accounts.

View source version on businesswire.com: https://www.businesswire.com/news/home/20211006005634/en/