Rainwater Tech – Innovator in Rainfall Generation Technology – to Become Publicly Traded through a Business Combination with dMY VI

- Rain Enhancement Technologies, Inc. ("Rainwater Tech") has entered into a business combination with dMY Technology Group, Inc. VI ("dMY VI"); once the business combination is completed, dMY VI is changing its ticker symbol on the New York Stock Exchange to the ticker symbol "RANY."

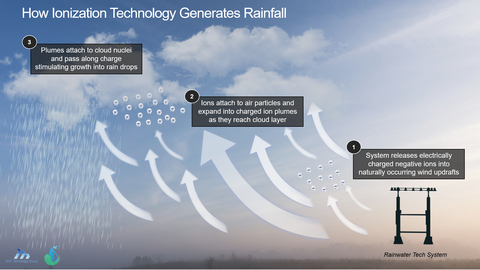

- Rainwater Tech's vision is to develop, invent, improve, manufacture, commercialize and operate technologies that enhance rainfall and elevate water reserves in the areas where it is needed most.

- Rainfall generation technology can address global issues including sustainable energy, food and water security, and climate change.

- Team includes world class pioneering scientists, entrepreneurs and proven public company leaders to help raise water table and support water positivity for cities, governments and industries.

- Third-party trials not associated with Rainwater Tech showed ground-based rainfall generation technology can enhance rainfall by 9%-18%, according to news reports; Rainwater Tech's rainfall ionization platform anticipated to be set up in the next two quarters, will require no chemical environmental pollutants, and is expected to be fully operational off the grid far from coastlines.

- Transaction has no minimum cash condition, with Rainwater Tech being capitalized via the approximately $241 million in dMY VI's trust account (assuming no redemptions).

- The transaction is expected to result in a pro forma valuation of $200 million.

- Business combination uniquely positions Rainwater Tech to develop, innovate, and scale this pre-existing technology and to drive commercialization through strong channel and board relationships to deliver services to both private industry and governments.

Rain Enhancement Technologies, Inc. ("Rainwater Tech"), a leader in the development of rainfall generation technology, and dMY Technology Group, Inc. VI (NYSE:DMYS) ("dMY VI"), a publicly traded special purpose acquisition company, today announced that they have entered into a business combination agreement.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20221222005128/en/

Rainwater Tech's rainfall generation technology can address global issues including sustainable energy, food and water security, and climate change. (Graphic: Business Wire)

Upon closing, the combined company is expected to retain the Rainwater Tech name. Once the business combination is completed, dMY VI will change its trading ticker from DMYS to the new ticker symbol "RANY."

Water Supply and Demand Imbalance Worsening

Increasing water scarcity challenges are seen in nearly every populated area on the globe. Crop yields are adversely impacted with inadequate access to water. Forest fires can disrupt whole states, unraveling centuries of natural carbon capture. Access to potable water has become a social justice and economic development issue not only in developing countries, but also in many developed nations. As geopolitical events have unfolded over the past year, the world is increasingly focused on water's elemental role in human and animal survival, food inflation, supply chain disruption, and energy. Alternative technologies to increase our water tables such as desalination and chemical cloud seeding possess considerable environmental, energy density, political, transportation and scalability challenges. Over the past few decades these alternatives have largely failed to prevent the acceleration of water scarcity all across America and Western Europe.

Rainwater Tech is led by world class pioneering scientists, entrepreneurs and proven public company leaders collaborating on a joint mission to help rebuild the water table for cities, government and industry. Third party trials of the pre-existing technology, called ground-based ionization for rain generation, have demonstrated the ability to enhance rainfall by as much as 9%-18%, according to news reports. At the same time, the company's commercial team has engaged and validated a strong customer base that is ready to leverage this rainfall ionization platform. Rainwater Tech is poised to develop, innovate and scale rainfall generation technology.

Rainwater Tech is led by co-founder and veteran public company CEO, Mike Nefkens, who previously ran the public industrial conglomerate Resideo Technologies and HPE Enterprise Services – a $20 billion, 100,000 person organization. At HPE, Mr. Nefkens was personally involved in the closing of over $30 billion in commercial contracts, helping to drive growth and ultimately culminating in the spin-off of the business at a $13 billion valuation in 2017. From 2018-2022, Mr. Nefkens was the CEO of Resideo Technologies (NYSE:REZI), a spin-off of Honeywell (NYSE:HON) with approximately $5 billion in revenue and 12,000 employees. Mr. Nefkens has strong global Fortune 500 customer relationships and is experienced in scaling organizations and building exceptional teams.

Rainwater Tech has established a roadmap and multiple vectors for development, innovation and improvement. The company has licensed certain relevant underlying IP as well as secured the services of leading engineers in the water technology and rainfall generation space. Over the last few years, scientific understanding of cloud condensation nuclei and the water cycle have advanced to the stage of global agreement on the underlying mechanisms. This foundation will allow Rainwater Tech's team to expeditiously advance commercialization alliances between private industry and government, including companies looking to reduce the impairment of property and land, supranational organizations, localities, developed nations exposed to high water stress, and developing nations that can make use of World Eco funds.

"Our vision is to be the first company of its kind in the water and climate adaptation space by facilitating the return of rain and moisture where it's needed most," said Mike Nefkens, CEO of Rainwater Tech. "This transaction enables us to develop, innovate and commercialize rainfall generation technology, backed by an expert management group and a best-in-class team of scientists, engineers, and business development leaders. We are excited to partner with dMY VI and leverage their experience in the area of frontier technologies, and to develop and launch to market augmentation technology and make a positive impact for our investors and our planet."

"Rainwater Tech's rainfall ionization platform will be poised to play a major role in increasing the water table for cities, government and industry and is uniquely positioned to meet massive market demand from private industry and governments around the globe," said Niccolo de Masi, CEO of dMY VI. "We are proud to back companies like Rainwater Tech that target high returns on invested capital and, large addressable markets, and are comprised of a team with extensive leadership experience – with the ability to address one of humanity's biggest challenges."

Transaction Overview

The transaction is expected to result in a pro forma valuation of $200 million.

After paying transaction expenses and the cash consideration, the balance of the approximately $241 million in cash held in dMY VI's trust account (assuming no redemptions), will be used for funding development, innovation and commercial scale.

The transaction, which has been unanimously approved by dMY VI's Board of Directors, is subject to customary closing conditions.

Conference Call Information

Rainwater Tech and dMY VI will host a joint investor conference call to discuss the proposed transaction, December 22, 2022 at 08:00 am ET. The call can be accessed at www.rainwatertech.com/investors and www.dmytechnology.com. The transcript of the investor conference call will be filed by dMY VI with the U.S. Securities and Exchange Commission ("SEC") and available on the SEC's website at www.sec.gov.

Management and Governance

Rainwater Tech's management team, led by CEO Mike Nefkens and Chief Product Officer Keri Waters, supported by Senior Technical Advisors Scott Morris and Dr. Ted Anderson, will continue to lead the public company following the transaction.

Advisors

TCF Law Group PLLC is acting as legal counsel to Rainwater Tech.

Cleary Gottlieb Steen & Hamilton LLP is acting as legal counsel to dMY VI.

About Rain Enhancement Technologies, Inc.

Rainwater Tech was founded to provide the world with reliable access to water, one of life's most important resources. To achieve this mission, Rainwater Tech aims to develop, manufacture and commercialize ionization rainfall generation technology. This weather modification technology seeks to provide the world with reliable access to water, and transform business, society and the planet for the better.

About dMY Technology Group, Inc. VI

dMY Technology Group, Inc. VI is a special purpose acquisition company founded by Niccolo de Masi and Harry You for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. Its Class A common stock, units and warrants trade on the NYSE under the ticker symbols DMYS, DMYS.U and DMYS WS, respectively. More information can be found at www.dmytechnology.com.

Additional Information and Where to Find It

In connection with the proposed business combination, dMY VI intends to file with the Securities and Exchange Commission (the "SEC") the Tender Offer Statement on Form SC-TO (the "Schedule TO") and other relevant materials (together with the Schedule TO, the "Securities Law Disclosure Documents"). dMY VI's stockholders are advised to read, once available, the Securities Law Disclosure Documents and any amendments thereto. dMY VI's stockholders may also obtain a copy of the Securities Law Disclosure Documents once available, as well as any other documents filed with the SEC by dMY VI, free of charge at the SEC's website at www.sec.gov. Before making any investment decision, investors and stockholders of dMY VI are urged to read the Securities Law Disclosure Documents and all other relevant materials filed or that will be filed with the SEC in connection with the proposed business combination because they will contain important information about the proposed business combination and the parties to the proposed business combination.

No Offer or Solicitation

This press release is for informational purposes only and shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction.

Disclaimers

Certain statements made in this release are "forward-looking statements" within the meaning of the "safe harbor" provisions of the United States Private Securities Litigation Reform Act of 1995 with respect to the proposed business combination between dMY VI and Rainwater Tech. Words or phrases such as "anticipate," "believe," "continue," "estimate," "expect," "intend," "may," "ongoing," "plan," "potential," "predict," "project," "will" or similar words or phrases, or the negatives of those words or phrases, may identify forward-looking statements, but the absence of these words does not necessarily mean that a statement is not forward-looking. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of other financial and performance metrics and projections of market opportunity. These statements are based on various assumptions, whether or not identified in this presentation, and on the current expectations of the respective management of dMY VI and Rainwater Tech and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by an investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of dMY VI and Rainwater Tech.

The risks and uncertainties include, but are not limited to: future operating or financial results; changes in domestic and foreign business, market, financial, political, and legal conditions; the inability of the parties to successfully or timely consummate the proposed business combination, including the risk that any regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the proposed business combination; failure to realize the anticipated benefits of the proposed business combination; risks related to the performance of Rainwater Tech's future technology or business and the timing of expected business or financial milestones; the amount of redemption requests made by dMY VI's stockholders; the ability of dMY VI or Rainwater Tech to issue equity or equity-linked securities or obtain debt financing in connection with the proposed business combination or in the future; if the proposed business combination's benefits do not meet the expectations of investors or securities analysts, the market price of dMY VI's securities or, following the closing, the combined entity's securities, may decline expected benefits of the business combination; and following the consummation of the proposed business combination, the combined company will incur significant increased expenses and administrative burdens as a public company, which could negatively impact its business, financial condition and results of operations.

Additional risks related to dMY VI and Rainwater Tech include, among others:

- Rainwater Tech can provide no assurance of the effectiveness and success of ionization rainfall generation technology in increasing precipitation;

- Rainwater Tech has no operating history or revenues, which makes it difficult to forecast its future results of operations;

- The execution of Rainwater Tech's business model, including technology or profitability of its products and services, is not yet proven;

- The rain generation industry is in its early stages and is volatile, and if it does not develop, if it develops slower than Rainwater Tech expects, if it develops in a manner that does not require use of Rainwater Tech's services, if it encounters negative publicity or if Rainwater Tech's solution does not drive commercial engagement, the growth of its business will be harmed;

- Rainwater Tech has not yet proven its ability to develop and implement new technologies, as well as the ability to obtain and maintain intellectual property protections for such technologies;

- A substantial portion of Rainwater Tech's technology is derived from public-source intellectual property and as a result Rainwater Tech may face increased competition;

- Even if Rainwater Tech is successful in developing rainfall generation systems/technology and executing its strategy, other competitors in the industry may achieve technological breakthroughs which render Rainwater Tech's technology obsolete or inferior to other products;

- If Rainwater Tech's platform fails to provide a broad, proven advantage in rainfall generation, its business, financial condition and future prospects may be harmed;

- Rainwater Tech's operating and financial results relies upon assumptions and analyses developed by third-party trials. If these assumptions or analyses prove to be incorrect, Rainwater Tech's actual operating results may be materially different from its forecasted results;

- Rainwater Tech's estimates of market opportunity and forecasts of revenue generation and market growth, including estimates of market opportunity and the ability to meet the supply and demand needs of our customers, may prove to be inaccurate, and even if the market in which it operates achieves the forecasted growth, Rainwater Tech's business could fail to grow at similar rates, if at all;

- Rainwater Tech may be unable to successfully manufacture its products or scale up manufacturing of its products in sufficient quantity and quality, in a timely or cost-effective manner, or at all. Unforeseen issues associated with scaling up and constructing rainfall generation systems at commercially viable levels could negatively impact Rainwater Tech's financial condition and results of operations;

- Rainwater Tech could suffer disruptions, outages, defects and other performance and quality problems with its rainfall generation systems or the infrastructure on which it relies;

- Supply chain issues, including a shortage of adequate supply or manufacturing capacity for its systems, could have an adverse impact on its business and operating results;

- If Rainwater Tech cannot successfully execute on its strategy, including in response to changing customer needs and new technologies and other market requirements, or achieve its objectives in a timely manner, its business, financial condition and results of operations could be harmed;

- Rainwater Tech's failure to effectively develop and expand its sales and marketing capabilities could harm its ability to increase its customer base and achieve broader market acceptance of its rain generation technology;

- The risk of third parties asserting that Rainwater Tech is violating their intellectual property rights;

- Risks relating to the production and manufacturing of Rainwater Tech's technology, including supply chain issues to obtain required materials, supplies and spare parts to build and operate its platform;

- Rainwater Tech must overcome significant engineering, technology, operations and climatological challenges to deliver consistent results;

- Rainwater Tech has not to date obtained statistically significant results, and faces risks and uncertainties relating to its ability to obtain statistically significant results and repeat success demonstrating its ability to enhance rainfall;

- Risks relating to the effect of competing technologies, including desalination and chemical-based cloudseeding technology, on Rainwater Tech's business;

- Risks relating to environmental and weather conditions that are correlated with successful rainfall generation, as well as other ESG-related matters;

- Rainwater Tech may face liability for changing environmental and/or weather conditions, including challenges resulting from excessive rain;

- Risks relating to the failures of Rainwater Tech's customers, both private and public, to meet payment obligations, including refusal to pay for rainfall generation services that directly or indirectly benefit other nearby parties;

- Risks of system securities and data protection breaches;

- Rainwater Tech is highly dependent on its senior technical advisors, and its ability to ability to attract, recruit, and retain senior management and other key employees, as well as find qualified labor with the particular skills required to manufacture, operate and advance the platform, is critical to its success; if Rainwater Tech is unable to retain talented, highly-qualified senior management and other key employees or attract them when needed, it could negatively impact its business;

- Risks regarding potential changes in legislative and regulatory environments that may limit the scope of Rainwater Tech's marketplace, including land restriction policies and its ability to obtain and maintain permits;

- Rainwater Tech may face political and social opposition to its business and activities;

- Following the consummation of the Business Combination, the combined company will incur significant increased expenses and administrative burdens as a public company, which could negatively impact its business, financial condition and results of operations;

- Rainwater Tech's success could be impacted by the inability of the parties to successfully or timely consummate the proposed Business Combination, including the risk that any required regulatory approvals are not obtained, are delayed, or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the proposed Business Combination; and

- If the Business Combination's benefits do not meet the expectations of investors or securities analysts, the market price of dMY VI's securities or, following the closing, the combined entity's securities, may decline.

You should carefully consider the risks and uncertainties that will be described in the Securities Law Disclosure Documents and any amendments thereto, once available.

Forward-looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. Our actual results could differ materially from those anticipated in forward-looking statements for many reasons. Accordingly, you should not unduly rely on these forward-looking statements, which speak only as of the date of this presentation. Except as required by law, we undertake no obligation to publicly revise any forward-looking statement to reflect circumstances or events after the date of this presentation or to reflect the occurrence of unanticipated events.

View source version on businesswire.com: https://www.businesswire.com/news/home/20221222005128/en/