Tempest Announces Strategic Acquisition of New Dual-CAR T Programs from Factor with Simultaneous Runway Extension Projected to Mid 2027

- All-stock acquisition includes clinical-stage CD19/BCMA Dual-CAR T program

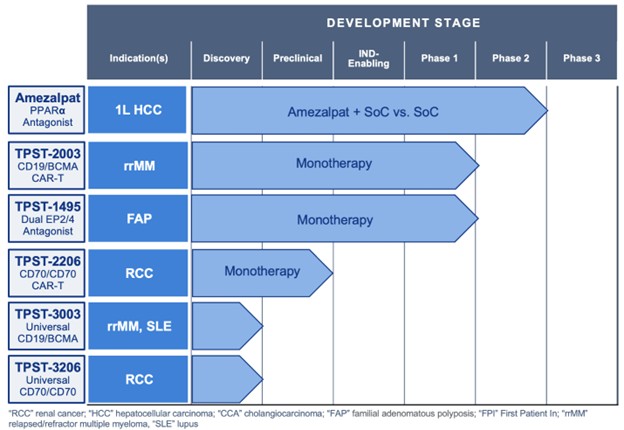

- Acquisition will expand existing advanced clinical-stage pipeline of amezalpat (PPAR⍺ Antagonist, Phase 3-ready) and TPST-1495 (Dual Ep2/4 Antagonist, Phase 2 start expected near term)

- The anticipated preclosing equity financing and an investment commitment from Factor Bioscience is expected to extend Tempest's runway to mid 2027 and through potentially significant milestones

- Plan to proceed with execution of globally approved protocol for amezalpat in first-line HCC subject to additional resources or partnerships

- Matt Angel, Ph.D. to assume role of President and CEO and Stephen Brady to assume role of Chairman of the board of directors upon closing of the acquisition

BRISBANE, Calif., Nov. 19, 2025 (GLOBE NEWSWIRE) -- In a transaction designed to both expand its pipeline and extend its runway, Tempest Therapeutics, Inc. (NASDAQ:TPST) ("Tempest" or "the Company"), a clinical-stage biotechnology company with a pipeline of targeted and immune-mediated therapeutics to fight cancer, today announced that it has entered into definitive agreements to acquire certain dual-targeting chimeric antigen receptor (CAR)-T programs from Factor Bioscience Inc. and its affiliates (collectively, "Factor") in an all-stock transaction (the "Proposed Transaction"). The Proposed Transaction is expected to close in early 2026, subject to necessary stockholder approvals and satisfaction of closing conditions (the "Closing").

The Proposed Transaction will expand and further diversify Tempest's existing clinical-stage pipeline, with the acquisition of the first clinical-stage CD19/BCMA parallel structured dual-CAR T specifically designed to target patients with extramedullary disease (EMD), which we are referring to as TPST-2003. In addition, the Company expects that existing cash at Closing and an investment commitment from Factor will support the Company's planned operations to mid 2027, including through potential key development and data milestones in 2026 and 2027.

Key Takeaways:

- Subject to stockholder approval and satisfaction of closing conditions, the Proposed Transaction will both further diversify Tempest's pipeline and extend the Company's runway to mid 2027, potentially through value-creating milestones

- Tempest plans to pursue business development discussions or an additional financing to advance the pivotal development of amezalpat (TPST-1120) in first-line liver cancer ("HCC")

- TPST-2003: dual CD19/BCMA CAR-T program

- Phase 1 complete in patients with relapsed multiple myeloma ("rrMM"), with data expected in 2026 and a biologics license application ("BLA") in China planned for 2027

- Phase 1 currently enrolling patients with POEMs syndrome, with data expected in 2027 and a BLA in China planned for 2028

- Tempest will have global rights to TPST-2003 outside of China, India, Turkey and Russia, and plans to pursue a potential registrational study in rrMM in the U.S. starting in 2027

- Data from Chinese pivotal study expected to validate probability of success for Tempest program, and rights will include the right to reference data generated in support of the planned China BLA

- Tempest expects a Phase 2 study of TPST-1495 in familial adenomatous polyposis ("FAP") to enroll the first patient in 2026 and to be funded by the National Cancer Institute and operationalized by the Cancer Prevention Clinical Trials Network

- Plan to continue the development of additional new preclinical and research-stage pipeline programs:

- TPST-2206: dual-targeting CD70/CD70 CAR-T for renal cell carcinoma

- TPST-3003: allogeneic dual-targeting CD19/BCMA

- TPST-3206: allogeneic dual-targeting CD70/CD70

- Tempest will issue 8,268,495 shares of its common stock, par value $0.001 per share ("Common Stock"), to an affiliate of Factor, equal to 65% of the outstanding shares of Common Stock, inclusive of newly issued shares, as of November 19, 2025.

- Existing Tempest stockholders will be entitled to receive one (1) common stock warrant for every share of Common Stock held and outstanding at a date immediately prior to the Closing (the "Warrants"). The Warrants will be immediately exercisable with an initial exercise price equal to $18.48 and will expire five years from the issuance date.

- Existing cash at Closing and an investment commitment from Factor is expected to provide a runway to mid 2027 and potentially through key data milestones.

- Upon Closing, Matt Angel, Ph.D. will become president and chief executive officer ("CEO") of Tempest and current Tempest president and CEO Stephen Brady will become Chairman of the Company's board of directors.

"The Proposed Transaction will result in an even more diversified portfolio that we believe provides stockholders with new opportunity for value creation and patients with new potential therapies," said Stephen Brady, president and chief executive officer of Tempest. "With the new funding support, Tempest has increased its opportunity to realize potential value creating milestones in the midst of this prolonged challenging market."

Dr. Angel added, "I echo Steve's sentiments and share in the vision to bring innovative therapies to patients with cancer. I believe there is significant potential to be realized in combining these programs and look forward to working with the Tempest team to bring these programs forward for the benefit of patients."

Combined Pipeline

Matt Angel, Ph.D.

Dr. Matt Angel is an experienced biotechnology executive with expertise in leading lean cell therapy companies. Dr. Angel led Brooklyn Immunotherapeutics (NASDAQ:BTX) as CEO from 2022-2023, successfully restructuring the company and extending the company's runway in a challenging market environment. Dr. Angel has led Factor Bioscience Inc. as co-founder and CEO since 2011 and is co-founder of cell therapy companies Novellus Therapeutics (founded 2014; sold 2021) and Exacis Biotherapeutics (founded 2020; sold 2023). Dr. Angel has deep expertise in cell therapy development and intellectual property protection and licensing. Dr. Angel is also experienced in assembling and managing multidisciplinary teams. A pioneer in cell engineering technology, Dr. Angel is a prolific inventor with more than 150 patents covering mRNA, nucleic acid delivery, gene editing, and cell reprogramming technologies. Dr. Angel received his Ph.D. from the Massachusetts Institute of Technology, where he published seminal discoveries in the then-nascent field of mRNA.

Approvals and Timing

The board of directors of Tempest has unanimously approved the Proposed Transaction and intends to recommend that Tempest stockholders vote to adopt the asset purchase agreement and the related issuance of Common Stock with respect to the Proposed Transaction at a meeting of stockholders.

The Proposed Transaction is conditioned upon approval of the holders of a majority of the outstanding shares of Common Stock of Tempest entitled to vote to adopt the asset purchase agreement with respect to the Proposed Transaction.

Completion of the transaction is expected in early 2026, subject to the approval of Tempest stockholders and the satisfaction of other customary closing conditions.

Advisors

MTS Health Partners, L.P. is serving as financial advisor to Tempest, and Cooley LLP is serving as legal advisor. In addition, MTS Securities, LLC (an affiliate of MTS Health Partners, L.P.) provided an opinion to the board of directors of Tempest regarding the fairness of the purchase price to be paid by Tempest to Factor in connection with the Proposed Transaction, subject to the qualifications and limitations set forth therein.

About Tempest Therapeutics

Tempest Therapeutics is a clinical-stage biotechnology company with a diverse portfolio of small molecule product candidates containing tumor-targeted and/or immune-mediated mechanisms with the potential to treat a wide range of tumors. The company's novel programs range from early research to later-stage investigation in a randomized global study in first-line cancer patients. Tempest is headquartered in Brisbane, California. More information about Tempest can be found on the company's website at https://www.tempesttx.com.

Forward-Looking Statements

This press release contains forward-looking statements (including within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended (the "Securities Act")) concerning Tempest Therapeutics, Inc. These statements may discuss goals, intentions, and expectations as to future plans, trends, events, results of operations or financial condition, or otherwise, based on current beliefs of the management of Tempest Therapeutics, as well as assumptions made by, and information currently available to, management of Tempest Therapeutics. Forward-looking statements contained in this press release include but are not limited to statements relating to: the anticipated closing of the Proposed Transaction; the investment commitment and extension of Tempest Therapeutics' cash runway through mid-2027; the potential benefits of the Proposed Transaction, including the combination of the programs and ability to benefit patients; the design, initiation, progress, timing, scope and results of clinical trials, including the anticipated Phase 3 study for amezalpat and the advancement of TPST-2003; anticipated therapeutic benefit and regulatory development of Tempest Therapeutics' product candidates; Tempest Therapeutics' ability to advance into a late-stage clinical company; and Tempest Therapeutics' ability to achieve its operational plans. Any forward-looking statements in this press release are based on Tempest Therapeutics' current expectations, estimates and projections about its industry as well as management's current beliefs and expectations of future events only as of today and are subject to a number of risks and uncertainties that could cause actual results to differ materially and adversely from those set forth in or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to, risks relating to volatility and uncertainty in the capital markets for biotechnology companies; the expected timing and likelihood of completion of the Proposed Transaction, including the timing, receipt and terms and conditions of any required approvals of the Proposed Transaction, including stockholder approval; Tempest Therapeutics' ability to continue to operate as a going concern; availability of suitable third parties with which to conduct contemplated strategic transactions; whether we will be able to pursue a strategic transaction, or whether any transaction, if pursued, will be completed on attractive terms or at all; unexpected safety or efficacy data observed during preclinical or clinical trials; clinical trial site activation or enrollment rates that are lower than expected; changes in expected or existing competition; changes in the regulatory environment; and unexpected litigation or other disputes. These and other factors that may cause actual results to differ from those expressed or implied are discussed in greater detail in the "Risk Factors" section of the Company's Quarterly Report on Form 10-Q for the quarter ended September 30, 2025 and other documents filed by the Company from time to time with the Securities and Exchange Commission. Except as required by applicable law, Tempest Therapeutics undertakes no obligation to revise or update any forward-looking statement, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise. These forward-looking statements should not be relied upon as representing Tempest Therapeutics' views as of any date subsequent to the date of this press release and should not be relied upon as prediction of future events. In light of the foregoing, investors are urged not to rely on any forward-looking statement in reaching any conclusion or making any investment decision about any securities of Tempest Therapeutics.

Investor Contacts:

Sylvia Wheeler

Wheelhouse Life Science Advisors

[email protected]

Aljanae Reynolds

Wheelhouse Life Science Advisors

[email protected]

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/51ecf37c-c6e4-423f-9cbc-85842ea50249