Texas Pacific Land Corporation Acquires Permian Oil and Gas Mineral and Royalty Interests in Cash Transaction

Acquisition of High-Quality Acreage in Core Regions of the Permian to Generate Accretive Growth

Texas Pacific Land Corporation (NYSE:TPL) (the "Company" or "TPL") today announced the closing of an acquisition of Permian oil and gas mineral and royalty interests for $286 million in cash.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20241002719080/en/

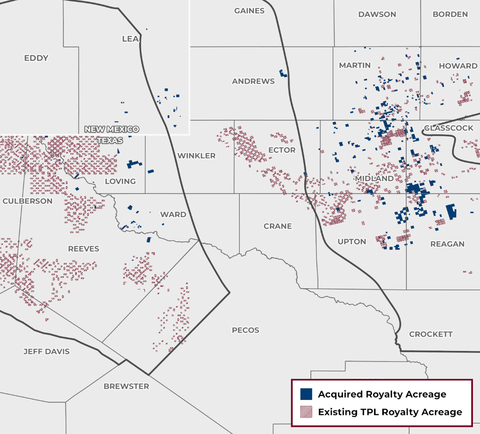

Asset Map (Graphic: Business Wire)

The interests span across approximately 7,490 net royalty acres ("NRA") located primarily in the Midland Basin in Martin (~2,220 NRA), Midland (~2,080 NRA), and other counties, with over 80% of the acquired interests adjacent to or overlapping existing TPL surface and royalty acreage. Exxon Mobil Corporation (NYSE:XOM) and Diamondback Energy Inc (NYSE:FANG) operate approximately 66% of the acreage. The acquired assets have current production of approximately 1,300 barrels of oil equivalent per day (~78% liquids), with strong line of sight to near-term development and production growth.

"These acquired assets simultaneously high-grade our legacy oil and gas royalty footprint, increase cash flow and earnings per share, and strengthen our growth profile," said Tyler Glover, Chief Executive Officer of the Company. "This acquisition significantly expands TPL's net royalty acreage in the Midland Basin, with the acquired assets located in some of the highest quality subregions prospective for multiple proven formations. The acreage is predominately operated by premier upstream companies such as Exxon, Diamondback, Occidental, and ConocoPhillips, with twelve rigs currently running on the footprint. We anticipate next-twelve-months production to generate a double-digit cash flow yield, with additional growth potential as over half of the Drilling and Spacing Units have seen limited, if any, development and contain numerous permits and recently drilled-but-uncompleted wells. Our recent acquisitions meaningfully enhance TPL's free cash flow per share, offering incremental flexibility to sustainably increase shareholder return of capital."

About Texas Pacific Land Corporation

Texas Pacific Land Corporation is one of the largest landowners in the State of Texas with approximately 873,000 acres of land in West Texas, with the majority of its ownership concentrated in the Permian Basin. The Company is not an oil and gas producer, but its surface and royalty ownership provide revenue opportunities throughout the life cycle of a well. These revenue opportunities include fixed fee payments for use of our land, revenue for sales of materials (caliche) used in the construction of infrastructure, providing sourced water and/or treated produced water, revenue from our oil and gas royalty interests, and revenues related to saltwater disposal on our land. The Company also generates revenue from pipeline, power line and utility easements, commercial leases and temporary permits related to a variety of land uses including midstream infrastructure projects and hydrocarbon processing facilities.

Visit TPL at http://www.TexasPacific.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20241002719080/en/