Thomas W. Jones Elected to the Church Pension Fund Board of Trustees; the Very Rev. Cynthia Briggs Kittredge Elected to Serve as a Vice Chair

Both Fill Vacancies Left by the Late Very Rev. Sandye A. Wilson

The Church Pension Fund (CPF), the sponsor and administrator of pension and other benefit plans for The Episcopal Church, announced the elections of Thomas W. Jones as a member of its Board of Trustees (CPF Board) and the Very Rev. Cynthia Briggs Kittredge as a Vice Chair of the CPF Board. They will fill the vacancies left by the Very Rev. Sandye A. Wilson, who passed away on April 15, 2025. Wilson was reelected to the CPF Board at the 81st General Convention of The Episcopal Church in 2024 and elected as a Vice Chair the same year.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250623626894/en/

The Church Pension Fund (CPF), the sponsor and administrator of pension and other benefit plans for The Episcopal Church, announced the elections of Thomas W. Jones as a member of its Board of Trustees (CPF Board) and the Very Rev. Cynthia Briggs Kittredge as a Vice Chair of the CPF Board. They will fill the vacancies left by the Very Rev. Sandye A. Wilson, who passed away on April 15, 2025.

"We are pleased to announce the elections of Thomas and Cynthia as CPF Trustee and CPF Vice Chair," said Canon Anne Vickers, Chair of the CPF Board. "Thomas and Cynthia are both recognized leaders in the Church and beyond and will bring valuable and relevant experience to their roles."

Mary Kate Wold, Chief Executive Officer and President of CPF, commented, "I am confident that Thomas and Cynthia will serve with the same dedication and commitment as Sandye. I am excited to work with them on behalf of those who serve our Church."

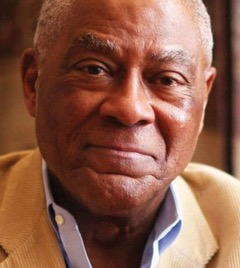

Thomas W. Jones

Thomas W. Jones is the founder and was a senior partner of venture capital investment firm TWJ Capital LLC since 2005 and retired in January 2025. He previously was Chief Executive Officer of Global Investment Management at Citigroup from 1997 to 2005; Vice Chairman, President, and Chief Operating Officer at TIAA-CREF from 1993 to 1997, and Executive Vice President and Chief Financial Officer at TIAA-CREF from 1989 to 1993; and Senior Vice President and Treasurer and other positions at John Hancock Life Insurance Company from 1982 to 1989. He began his career in management consulting at Arthur Young & Company (predecessor firm to Ernst & Young) in 1973.

He is a member of the public company boards of directors of Assured Guaranty Ltd. (NYSE:AGO) and Jefferies Financial Group (NYSE:JEF). He has served previously on the corporate boards of Altria Group, Freddie Mac, Travelers Group, TIAA-CREF, Fox Entertainment Group, Pepsi Bottling Group, Thomas & Betts Corp, Eastern Enterprises, and Federal Reserve Bank of New York (former Vice Chairman). He has served on the nonprofit boards of trustees of Cornell University, Cornell University Medical College, Howard University, Massachusetts General Hospital, Children's Hospital Medical Center (Boston), PBS Channel Thirteen (New York), Brookings Institution, and Boston Ballet Company.

Thomas received a BA and an MS from Cornell University and an MBA from Boston University. He has also been awarded honorary doctoral degrees by Howard University (Doctor of Humane Letters), Pepperdine University (Doctor of Laws), and the College of New Rochelle (Doctor of Commercial Science).

He is a trustee emeritus of Cornell University, recipient of the Frank H. T. Rhodes Exemplary Alumni Service Award, and has been elected Presidential Councillor, Cornell University's highest distinction. He is the author of From Willard Straight to Wall Street: A Memoir (2019), winner of the 2020 Axiom Business Book Award Bronze Prize in the memoir/biography category.

Thomas is a Certified Public Accountant (CPA, Commonwealth of Massachusetts) and has been designated Board Governance Fellow by the National Association of Corporate Directors (NACD).

The Very Rev. Cynthia Briggs Kittredge, ThD

The Very Rev. Cynthia Briggs Kittredge is the Dean Emerita of the Seminary of the Southwest. She was appointed in 2013 after serving on the faculty as the Ernest J. Villavaso, Jr. Professor of New Testament and as Academic Dean.

Dean Kittredge has served as a member of the Steering Committee for Theological Education in the Anglican Communion, as Chair of the Board of the Episcopal Evangelism Society, and as President of the Anglican Association of Biblical Scholars.

She is a contributor to The New Oxford Annotated Bible and Women's Bible Commentary, and the author of Conversations with Scripture: The Gospel of John and Community and Authority: The Rhetoric of Obedience in the Pauline Tradition. She coedited The Bible in the Public Square: Reading the Signs of the Times and Walk in the Ways of Wisdom: Essays in Honor of Elisabeth Schüssler Fiorenza. She is the coeditor of the Fortress Commentary on the Bible: The New Testament. She also wrote A Lot of the Way Trees Were Walking: Poems from the Gospel of Mark.

Prior to joining the seminary faculty in 1999, Dean Kittredge taught at Harvard University and the College of the Holy Cross. She serves as assisting priest at The Episcopal Church of the Good Shepherd in Austin, Texas.

Dean Kittredge was elected to her first term on The Church Pension Fund Board of Trustees in 2022.

She received her MDiv, ThM, and ThD from Harvard and a BA from Williams College.

About the Church Pension Group

The Church Pension Group (CPG) is a financial services organization that serves The Episcopal Church. It maintains three lines of business—benefits, property and casualty insurance, and publishing. CPG provides retirement, health, life insurance, and related benefits for clergy and lay employees of The Episcopal Church, as well as property and casualty insurance and book and music publishing, including the official worship materials of the Church. Follow CPG on Facebook, X, YouTube, Instagram, and LinkedIn. cpg.org

View source version on businesswire.com: https://www.businesswire.com/news/home/20250623626894/en/

Media:

C. Curtis Ritter

Senior Vice President

Head of Content & Creative Services

(212) 592-1816

[email protected]