WaterBridge Announces Open Season on Long-Haul Produced Water Pipeline to Central Basin Platform

Dual 30" pipelines will provide access to over 4 million bpd of contiguous pore space with majority of active permits located on the Central Basin Platform

Anticipated in-service date of 4Q25

WaterBridge today announced the launch of an open season to solicit commitments to support the construction of two new large-diameter gathering and transportation pipelines (together, the "Speedway Pipeline"). The open season began at 8:00 a.m. CDT today, April 1, 2025, and is scheduled to end at 5:00 p.m. CDT on May 1, 2025.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250401236710/en/

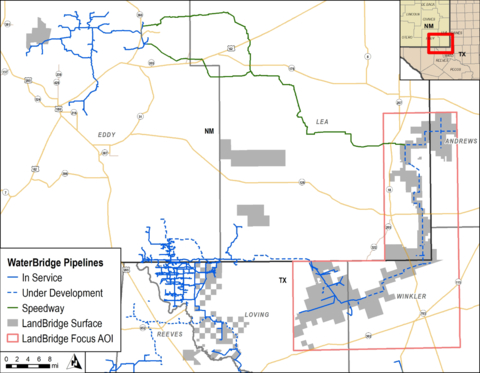

The Speedway Pipeline will consist of dual 30" pipelines extending across the Northern Delaware Basin to connect Eddy and Lea counties to out-of-basin pore space in the Central Basin Platform owned by WaterBridge's affiliate, LandBridge Company LLC (NYSE:LB). The Speedway Pipeline will allow WaterBridge to transport produced water away from high-activity areas that are experiencing rising pore pressures and is expected to enhance flow assurance and redundancy for WaterBridge's customers and support future growth for the industry by utilizing LandBridge's significant pore space capacity. The Speedway Pipeline will access approximately 1MM bpd of approved capacity on the Central Basin Platform.

"The Speedway Pipeline addresses the critical need for produced water handling capacity in the Northern Delaware Basin," said Michael "Chop" Reitz, President and Chief Operating Officer of WaterBridge. "By connecting southeastern New Mexico to the Central Basin Platform, we are providing operators with access to largely undeveloped pore space on LandBridge's surface. This project underscores our commitment to providing the water infrastructure needed to support development plans and continued growth in the region."

The anticipated route for the Speedway Pipeline is shown on the enclosed map.

Additional information and open season documents, including the transportation services and confidentiality agreements, are available to potential customers through the following website link: https://h2obridge.com/contact-us/speedway/

For any other information, please submit requests via email to [email protected].

About WaterBridge

NDB Midstream LLC is a strategic partnership between Five Point Energy and Devon Energy Corp. (NYSE:DVN) that operates large-scale produced water transportation, handling, recycling and reuse assets in the Northern Delaware Basin in West Texas and New Mexico and the Eagle Ford Basin in South Texas.

WaterBridge Operating LLC is a portfolio company of Five Point Energy and GIC that operates large-scale produced water transportation, handling, recycling and reuse assets in the Southern Delaware Basin in West Texas and the Arkoma Basin in Oklahoma.

Collectively, WaterBridge handles approximately 2.4 million bpd of produced water and owns approximately 4.2 million bpd of produced water handling capacity along with 2,400 miles of pipeline. Headquartered in Houston, Texas, WaterBridge benefits from a first-mover advantage in the water midstream sector and a deeply experienced and entrepreneurial management team. For further information, please visit www.h2obridge.com.

About LandBridge

LandBridge owns more than 276,000 surface acres across Texas and New Mexico, located primarily in the heart of the Delaware sub-region in the Permian Basin, the most active region for oil and natural gas exploration and development in the United States. LandBridge actively manages its land and resources to support and encourage energy and infrastructure development and other land uses, including digital infrastructure. LandBridge was formed by Five Point Energy, a private equity firm with a track record of investing in and developing energy, environmental water management and sustainable infrastructure companies within the Permian Basin. For more information, please visit: www.landbridgeco.com.

About Five Point Energy

Five Point Energy is a private equity firm focused on building businesses within the environmental water management, surface management, and sustainable infrastructure sectors. The firm was founded by industry veterans who have had successful careers investing in, building, and running midstream infrastructure companies. Five Point's strategy is to buy and build assets, create companies, and grow them into sustainable enterprises with premier management teams and industry-leading E&P partners. Based in Houston, Five Point targets equity investments up to $1 billion and has approximately $8 billion of assets under management across multiple investment funds. For more information about Five Point Energy, please visit: www.fivepointenergy.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250401236710/en/

Scott McNeely

Chief Financial Officer

WaterBridge

[email protected]

Media

Daniel Yunger / Nathaniel Shahan

Kekst CNC

[email protected] / [email protected]