Xali Gold Completes Due Diligence Visit, Confirms Data Integrity and Exploration Upside at Pico Machay Gold Project in Peru

VANCOUVER, British Columbia, Nov. 19, 2025 (GLOBE NEWSWIRE) -- Xali Gold Corp. (TSXV:XGC) ("Xali Gold" or the "Company") is pleased to report that due diligence site visits for the Pico Machay Gold Project ("Pico Machay" or the "Project") in Central Peru have been completed and confirm the high quality and integrity of the historical work. The Project is under acquisition through a Share Purchase Agreement ("SPA") with Pan American Silver Corp. (TSX:PAAS) (NYSE:PAAS) ("Pan American") and its subsidiary, Aquiline Resources Inc. ("Aquiline") as per the October 24th, 2025 news release.

Xali Gold has now completed three site visits between June and November of this year, providing strong confidence in the integrity of the historical work conducted on the property by Aquiline Resources, their predecessors and also by Pan American. Participants of the site visits have included Xali Gold technical team and management, Xali Gold Qualified Person ("QP ") David Thomas of DKT Geosolutions ("DKT"), as well as representatives for local investors. David Thomas has verified the historic geological model, confirmed the accuracy of drill collar locations, and validated the reliability of the assays from historic drilling through independent check sampling. These results speak to the integrity of the dataset and support the preparation of an updated National Instrument 43-101 report as required by the TSXV for this acquisition. This report will also serve as the foundation for converting the historic mineral resource estimate to a current estimate.

"The Project has delivered a major and highly encouraging surprise: the alteration footprint is substantially more extensive than we had understood, spanning about 4.1km by 1.3km (533 hectares)," stated Joanne Freeze, President and CEO of Xali Gold. "By comparison, the surficial expression of the current resource occupies approximately 800m by 350m (28 hectares) - approximately 5% of the altered-mineralized broader system – which highlights the substantial exploration upside that remains open for discovery. Not only does Pico Machay offer immediate value potential, given that the original resource was based on a long-term gold price of only US$700 per ounce, but the extensive undrilled areas within this large alteration system provide exceptional opportunity for both resource expansion and new discoveries."

Video highlights from the latest Pico Machay site visit are now available.

Xali Gold engaged David Thomas of DKT to carry out a comprehensive due diligence site visit in October 2025. During the visit, DKT verified key elements of the geological model through examination of surface outcrops, collected GPS coordinates for drill collar locations, gathered 26 samples (including 9 surface samples and 17 pulp and coarse reject samples), and conducted a thorough review of RC chip samples stored in Lima, Peru.

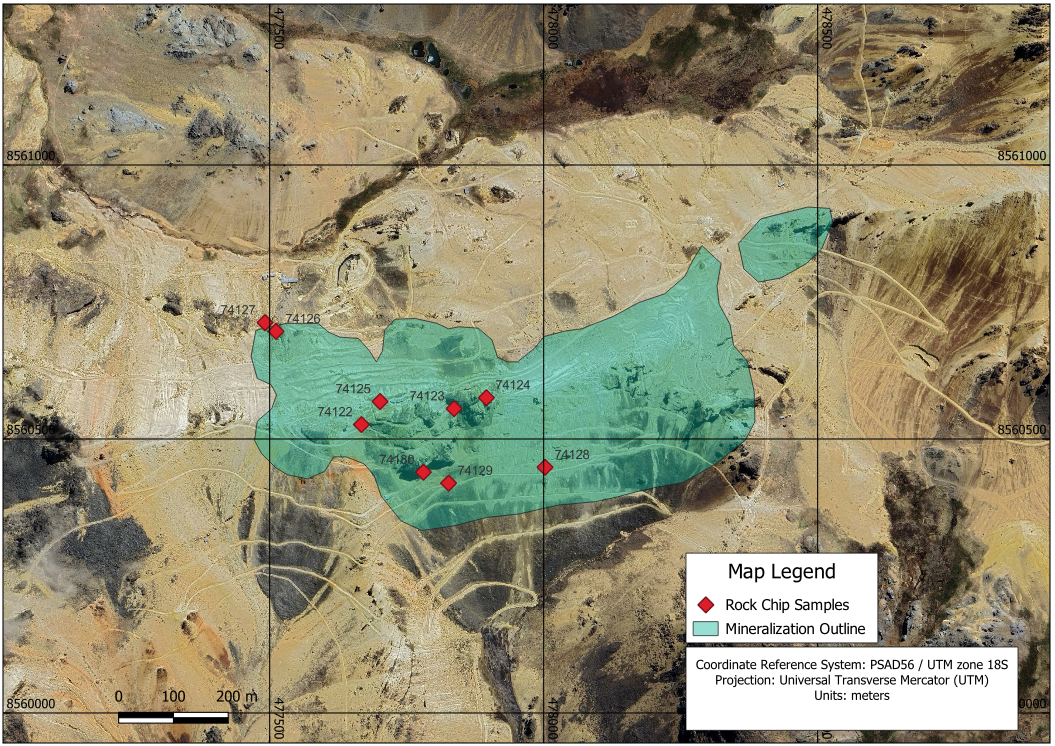

The new rock chip samples collected at Pico Machay reinforce the strength of the system, confirming both higher-grade and lower-grade gold and silver values, as summarized in Table 1 and Figure 1 below. Drill collar positions were validated as reasonably accurate, and check assays from pulp and coarse reject material confirm strong assay reliability. Overall, the dataset shows excellent integrity—sufficiently accurate and robust to support an updated National Instrument 43-101 mineral resource estimate, which is now well underway and expected to be completed in the coming months.

Pico Machay has a historic Measured and Indicated Resource of 264,600 ounces ("oz") of gold (10.6 million ("M") tonnes grading 0.78 grams per tonne ("gpt") gold) and an additional Historic Inferred Resource of 446,000 oz of gold (23.9 M tonnes grading 0.58 gpt gold). Additional details about Pico Machay, including a video with highlights from the site visit, can be found on the Xali Gold website at: Xali Gold Corp. | Overview

Table 1: Assay Results from Rock Chip Samples

| Sample Number | Gold (g/t) | Silver (g/t) |

| 74122 | 0.21 | 0.5 |

| 74123 | 3.98 | 25.8 |

| 74124 | 2.23 | 11.2 |

| 74125 | 2.86 | 7.3 |

| 74126 | 0.14 | 1.4 |

| 74127 | 0.16 | <0.5 |

| 74128 | 2.60 | 1.3 |

| 74129 | 2.07 | 1.0 |

| 74130 | 1.80 | 1.0 |

Figure 1: Rock Chip Sample Locations

All samples rock chip samples were collected in the field using a hammer. Sample locations were obtained using a handheld GPS with samples placed in pre-labelled sample bags. Samples were securely transported by field staff to ALS Chemex's laboratory in Lima, Peru for standard sample preparation (Prep 32) which includes drying at 105°C, crush to 70% passing 2 mm, riffle split 1000g and pulverize 85% passing 75 microns. 30g pulps were then analyzed for gold and silver by fire assay with an AAS finish (code Au-AA23). Silver analysis was performed using 4-acid digest with an ICP-AAS finish (Code Ag-ICP61). A Quality Assurance/Quality Control protocol was incorporated into the program and included the insertion of certified reference material at and blanks at a rate of approximately 5% and 5%, respectively. ALS Chemex is independent of the Company.

Management cautions that surface rock chip samples and associated assays, as discussed herein, are selective by nature and represent a point location, and therefore may not necessarily be fully representative of the mineralized horizon sampled.

Technical Information

Information regarding the historic mineral resource at Pico Machay was obtained from the report titled: "Independent Technical Report and Resource Estimate Pico Machay Gold Deposit" prepared by Caracle Creek International Consulting Inc. for Aquiline dated November 25th, 2009. The mineral resource numbers are included in the Pan American News Release dated September 11, 2024 and found on both the Pan American website and on www.sedarplus.ca. All mineral resource estimates have used the same categories in accordance with CIM Standards on Mineral Resources and Reserves.

All resource estimates for Pico Machay are considered historic in nature and are based on prior data and reports prepared by previous property owners. The Company views the estimate as a meaningful reference point for planning current exploration activities and assessing the Project's potential, but a qualified person has not done sufficient work yet to classify the historic estimates as current resources in accordance with current CIM categories and the Company is not treating the historic estimates as current resources. Significant data compilation, redrilling, resampling and data verification may be required by a qualified person before the historical estimates on the project can be classified as a current resource. There can be no assurance that any of the historic mineral resources, in whole or in part, will ever become economically viable. In addition, mineral resources are not mineral reserves and do not have demonstrated economic viability. Even if classified as a current resource, there is no certainty as to whether further exploration will result in any inferred mineral resources being upgraded to an indicated or measured resource category.

Xali Gold is dedicated to being a responsible community partner.

Both David G. Thomas, P.Geo. and Joanne C. Freeze, P.Geo. Qualified Persons as defined by National Instrument 43-101 have reviewed and approved the contents of this release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

On behalf of the Board of Xali Gold Corp.

"Joanne Freeze" P.Geo.

President, CEO and Director

For further information please contact:

Joanne Freeze, President & CEO

Tel: + 1 604-512-3359

[email protected]

Forward-looking Disclaimer

This press release contains forward-looking information within the meaning of Canadian securities laws ("forward-looking statements"). Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, plans, postulate and similar expressions, or are those, which, by their nature, refer to future events. All statements that are not statements of historical fact are forward-looking statements.

Forward-looking statements in this press release include, without limitation: the timing to close the SPA and meet closing conditions; potential upside and production from and viability of the Pico Machay Project; the potential tonnage, grades and content of deposits; the steps and timing to convert historical mineral resource estimates to current estimates for the Company. These forward-looking statements are made as of the date of this press release. Although the Company believes the forward-looking statements in this press release are reasonable, it can give no assurance that the expectations and assumptions in such statements will prove to be correct. The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and are subject to risks, uncertainties, assumptions and other factors which could cause events or outcomes to differ materially from those expressed or implied by such forward-looking statements.

Known risk factors and assumptions include risks associated with exploration and project development; accessing further funding and related dilution: continuing its projected growth, or being fully able to implement its business strategies; the calculation of mineral resources and additional work required to convert historical resources to current mineral resources; the nature, quality and quantity of any mineral deposits that may be located on the project; operational risks associated with mining and mineral processing; fluctuations in metal prices and assumptions including costs; title matters; government regulation; obtaining and renewing necessary consents, authorizations, licenses and permits; environmental liability and insurance; reliance on key personnel; local community opposition; currency fluctuations; labour disputes; competition; variations in market conditions, and the volatility of our common share price and volume; future sales of shares by existing shareholders; and other risk factors described in Xali Gold's MD&A and other filings with Canadian securities regulators, which may be viewed at www.sedarplus.ca. Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended.

There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Xali Gold expressly disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except in accordance with applicable securities laws.

CAUTIONARY NOTE TO U.S. INVESTORS

We advise U.S. investors that this news release uses terms defined in the 2014 edition of the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) "CIM Definition Standards on Mineral Resources and Mineral Reserves", as incorporated by reference in Canadian National Instrument 43-101 "Standards of Disclosure for Mineral Projects", for reporting of mineral resource estimates. These Canadian standards, including NI 43-101, differ from the requirements of the United States Securities and Exchange Commission (SEC) as set forth in the mining disclosure rules under Regulation S-K 1300. Regulation S-K 1300 uses the same terminology for mineral resources, but the definitions are not identical to NI 43-101 and CIM Definition Standards. Regulation S-K 1300 uses the term "initial assessment" for an evaluation of potential project economics based on mineral resources. This study type has some similarities to a Preliminary Economic Assessment, but the definition and content requirements of an initial assessment are not identical to the definition and content requirements for a PEA under NI 43-101.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/072193b7-8539-4a54-a2a6-907d91d561db