VANCOUVER, British Columbia, Oct. 28, 2025 (GLOBE NEWSWIRE) -- Xali Gold Corp. (TSXV:XGC) ("Xali Gold" or the "Company") is pleased to announce plans to advance the Pico Machay Gold Project ("Pico Machay" or the "Project") in Central Peru. The Project is under acquisition through a Share Purchase Agreement ("SPA") with Pan American Silver Corp. (TSX:PAAS) (NYSE:PAAS) ("Pan American") and its subsidiary, Aquiline Resources Inc. ("Aquiline") as per the October 24th, 2025 news release.

The Pico Machay transaction is considered a fundamental acquisition for Xali Gold and therefore, pursuant to Policy 5.3, was pending the receipt and review of acceptable documentation by the TSX Venture Exchange ("TSX-V"). The TSX-V has now advised the Company that with this news release issued, the requirements in section 5.6(d) of Policy 5.3 have now been met and the trading halt will be lifted such that Xali Gold will resume trading tomorrow Wednesday October 29th, 2025.

Pico Machay has a historic Measured and Indicated Resource of 264,600 ounces ("oz") of gold (10.6 million ("M") tonnes grading 0.78 grams per tonne ("gpt") gold) and an additional Historic Inferred Resource of 446,000 oz of gold (23.9 M tonnes grading 0.58 gpt gold). David Thomas, Independent Qualified Person ("QP"), completed a site visit of Pico Machay from October 21 to 24, 2025 and collected 26 samples. Nine of these samples were collected on the property and 17 samples were collected from pulps and rejects to allow his due diligence on the reported mineralized zones and the Historic Resource. A total of 154 reverse circulation holes drilled prior to 2009, were relied upon to delineate the Historic Resource. All of these holes were drilled in a central zone while nine additional high-potential exploration targets remain untested.

Xali Gold plans to commence field work by advancing exploration targets in preparation for drill testing; initiating a bulk sampling program, both to confirm grades from previous drilling and better understand the higher grade zones; and also by conducting additional metallurgical testing to confirm and potentially increase estimated recoveries from previous work. Importantly, all this immediate work can be conducted without the need for additional permits, allowing Xali Gold to continue advancing the Project while applying for the necessary permits for drilling from surface.

"Pico Machay offers Xali Gold both immediate value and substantial upside, especially given that the original resource was calculated using a long-term gold price of just US$700 per ounce. With the current gold prices, our priority is to move Pico Machay forward aggressively," said Joanne Freeze, President and CEO of Xali Gold. "Over the next six months, our goal is to update the historic resource estimate using currently accepted long-term gold prices, as well as review and optimize previous engineering studies. Previous owners of Pico Machay outlined a low-cost, low-strip ratio open pit heap-leach operation. Xali Gold will work to update these studies to re-estimate the Project's current economic potential with a goal to move quickly and cost-effectively toward our goal of near-term production."

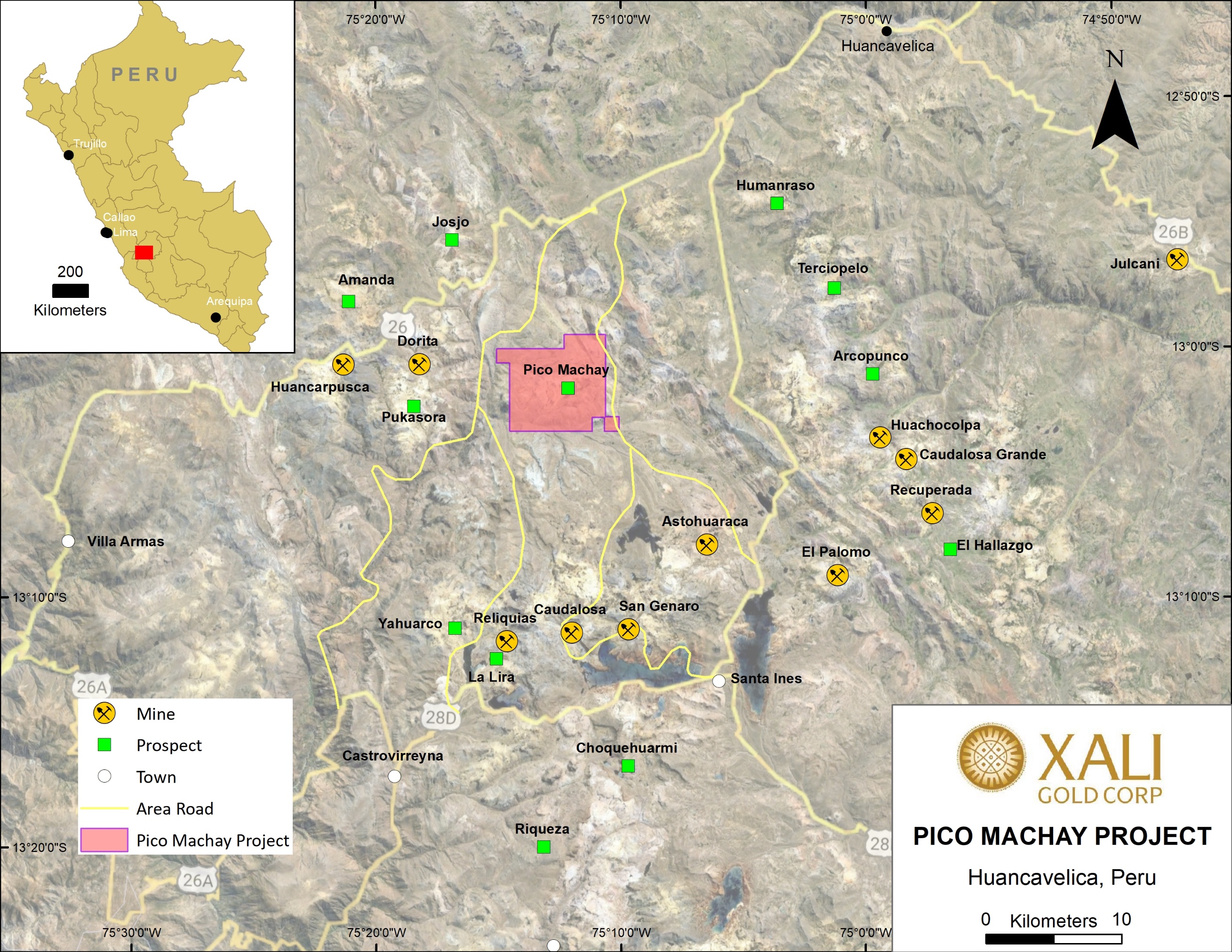

The Project lies within the northern extent of the Southern Peru Epithermal Gold-Silver Belt and in the eastern part of Western Cordillera Andes within a well-established mining area/district. Minera IRL Ltd.'s Corihuarmi Mine operates 63 km north of Pico Machay. Several mines within a 45km radius of Pico Machay including: Lalira, San Genoro, Astohuaraca, El Paloma, Cauduloso, Reliquias and Recuperada (see Figure 1 below). The property comprises seventeen claims covering 4,700 hectares and all claims are in good standing.

Figure 1: Pico Machay location map in comparison to existing mines and prospects

Details of Share Purchase Agreement

As per the October 24th, 2025 news release, Xali Gold entered into an SPA on October 23rd to acquire the company Minera Calipuy S.A.C ("Calipuy"), which wholly owns Pico Machay, from Pan American and its subsidiary, Aquiline.

The transaction with Pan American and Aquiline to acquire 100% of their collective interest in Calipuy is arm's length and no finders' fees were paid. The $17.5M in deferred payments are secured by: Promissory Notes for each of the six deferred payments; a first-priority Share Pledge Agreement over 100% of Calipuy's shares; and a first-priority Mortgage Agreement over both the Pico Machay property as well as the Company's Las Brujas II property in Peru. A total of $15M will be paid over 5 years for the known historic gold resource. If a minimum of 1.25M oz Au aggregate mineral reserves or mineral resources classified as any of proven mineral reserves, probable mineral reserves, measured mineral resources, or indicated mineral resources (as per CIM Definitions) are disclosed in a National Instrument ("NI") 43-101 technical report then Xali Gold is to pay an additional $2.5M. Xali Gold has provided Pan American with a Purchaser's Special Indemnity. This indemnity is unlimited in amount and indefinite in duration and covers all existing and future liabilities (environmental, tax, labour, etc.) of the Project.

Details on the cash payments (all dollar values are United States dollars):

| Time Period | Cash Payments |

| Closing of Transaction | $0.5M |

| 1st Year Anniversary | $1.5M |

| 2nd Year Anniversary | $1.5M |

| 3rd Year Anniversary | $4.0M |

| 4th Year Anniversary | $3.0M |

| Earlier of 5th Year Anniversary or commencement of commercial production | $4.5M |

| On delineating a minimum of 1.25M oz Au in a NI43-101 compliant Measured and Indicated Resource or Proven and Probable Reserve | $2.5M |

| Total | $17.5M |

Closing of the transactions under the SPA are subject to customary closing conditions for transactions of this nature, as set out in the SPA, including TSX-V approval for Xali Gold. Pan American will retain certain security interests over Calipuy, subject to Xali Gold's completion of the deferred payments under the SPA.

Technical Information

Information regarding the historical resource at Pico Machay was obtained from the report titled: "Independent Technical Report and Resource Estimate Pico Machay Gold Deposit" prepared by Caracle Creek International Consulting Inc. for Aquiline (purchased by Pan American) on November 25th, 2009. The resource numbers are highlighted in the Pan American News Release dated September 11, 2024 and found on both the Pan American website and on www.sedarplus.ca. All resource estimates have used the same categories in accordance with CIM Standards on Mineral Resources and Reserves.

All resource estimates for Pico Machay are considered historical in nature and are based on prior data and reports prepared by previous property owners. A qualified person has not done sufficient work yet to classify the historical estimates as current resources in accordance with current CIM categories and the Company is not treating the historical estimates as current resources. Significant data compilation, redrilling, resampling and data verification may be required by a qualified person before the historical estimates on the project can be classified as a current resource. There can be no assurance that any of the historical mineral resources, in whole or in part, will ever become economically viable. In addition, mineral resources are not mineral reserves and do not have demonstrated economic viability. Even if classified as a current resource, there is no certainty as to whether further exploration will result in any inferred mineral resources being upgraded to an indicated or measured resource category.

Xali Gold is dedicated to being a responsible community partner.

Both David G. Thomas, P.Geo. and Joanne C. Freeze, P.Geo. Qualified Persons as defined by National Instrument 43-101 have reviewed and approved the contents of this release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

On behalf of the Board of Xali Gold Corp.

"Joanne Freeze" P.Geo.

President, CEO and Director

For further information please contact:

Joanne Freeze, President & CEO

Tel: + 1 604-512-3359

[email protected]

Forward-looking Disclaimer

This press release contains forward-looking information within the meaning of Canadian securities laws ("forward-looking statements"). Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, plans, postulate and similar expressions, or are those, which, by their nature, refer to future events. All statements that are not statements of historical fact are forward-looking statements.

Forward-looking statements in this press release include, without limitation: the timing to close the SPA and meet closing conditions; potential upside and production from and viability of the Pico Machay Project; the potential tonnage, grades and content of deposits; the steps and timing to convert historical mineral resource estimates to current estimates for the Company. These forward-looking statements are made as of the date of this press release. Although the Company believes the forward-looking statements in this press release are reasonable, it can give no assurance that the expectations and assumptions in such statements will prove to be correct. The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and are subject to risks, uncertainties, assumptions and other factors which could cause events or outcomes to differ materially from those expressed or implied by such forward-looking statements.

Known risk factors and assumptions include risks associated with exploration and project development; accessing further funding and related dilution: continuing its projected growth, or being fully able to implement its business strategies; the calculation of mineral resources and additional work required to convert historical resources to current mineral resources; the nature, quality and quantity of any mineral deposits that may be located on the project; operational risks associated with mining and mineral processing; fluctuations in metal prices and assumptions including costs; title matters; government regulation; obtaining and renewing necessary consents, authorizations, licenses and permits; environmental liability and insurance; reliance on key personnel; local community opposition; currency fluctuations; labour disputes; competition; variations in market conditions, and the volatility of our common share price and volume; future sales of shares by existing shareholders; and other risk factors described in Xali Gold's MD&A and other filings with Canadian securities regulators, which may be viewed at www.sedarplus.ca. Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended.

There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Xali Gold expressly disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except in accordance with applicable securities laws.

CAUTIONARY NOTE TO U.S. INVESTORS

We advise U.S. investors that this news release uses terms defined in the 2014 edition of the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) "CIM Definition Standards on Mineral Resources and Mineral Reserves", as incorporated by reference in Canadian National Instrument 43-101 "Standards of Disclosure for Mineral Projects", for reporting of mineral resource estimates. These Canadian standards, including NI 43-101, differ from the requirements of the United States Securities and Exchange Commission (SEC) as set forth in the mining disclosure rules under Regulation S-K 1300. Regulation S-K 1300 uses the same terminology for mineral resources, but the definitions are not identical to NI 43-101 and CIM Definition Standards. Regulation S-K 1300 uses the term "initial assessment" for an evaluation of potential project economics based on mineral resources. This study type has some similarities to a Preliminary Economic Assessment, but the definition and content requirements of an initial assessment are not identical to the definition and content requirements for a PEA under NI 43-101.