TORONTO, Jan. 15, 2026 (GLOBE NEWSWIRE) -- TRX Gold Corporation (TSX:TRX) (NYSE:TRX) (the "Company" or "TRX Gold") reported its results for the first quarter of 2026 ("Q1 2026") for the three months ended November 30, 2025. Financial results are available on the Company's website at www.TRXgold.com. Unless otherwise noted, all references to currency in this press release refer to US dollars.

TRX Gold's CEO, Stephen Mullowney commented: "In Q1, we once again delivered record results, in line with guidance shared last quarter, pouring a record 6,597 ounces of gold and selling 6,492 ounces of gold at an average realized price of $3,860 per ounce, generating revenue of $25.1 million, gross profit of $14.2 million (57% margin) and EBITDA1 of $13.2 million (53% margin). The strong cash flow in a record gold price environment has enabled us to meaningfully reinvest in TRX Gold's growth. During the quarter, we strengthened our working capital position, advanced plans to upgrade and expand our processing plant to improve our production profile, and increased investment in exploration to further delineate resources at Buckreef Gold. The Company is entering a new phase of growth, with improving production scale, stronger margins and a growing resource base. We are very encouraged by the progress and excited about the year ahead."

Key highlights for Q1 2026 include:

- Record Production, Revenue, and EBITDA: During Q1 2026, Buckreef Gold poured a record 6,597 ounces of gold and sold 6,492 ounces of gold at a record average realized price1 of $3,860 per ounce, recognizing revenue of $25.1 million, gross profit of $14.2 million, adjusted net income1 of $7.7 million, operating cash flow of $4.0 million and EBITDA1 of $13.2 million, all of which reflect significant increases compared to the prior year comparative period, demonstrating the Company's leverage to record gold prices during Q1 2026. The Company remains on track to achieve its fiscal 2026 production guidance of 25,000 – 30,000 ounces of gold at a total average cash cost of $1,400 - $1,600 per ounce at Buckreef Gold.

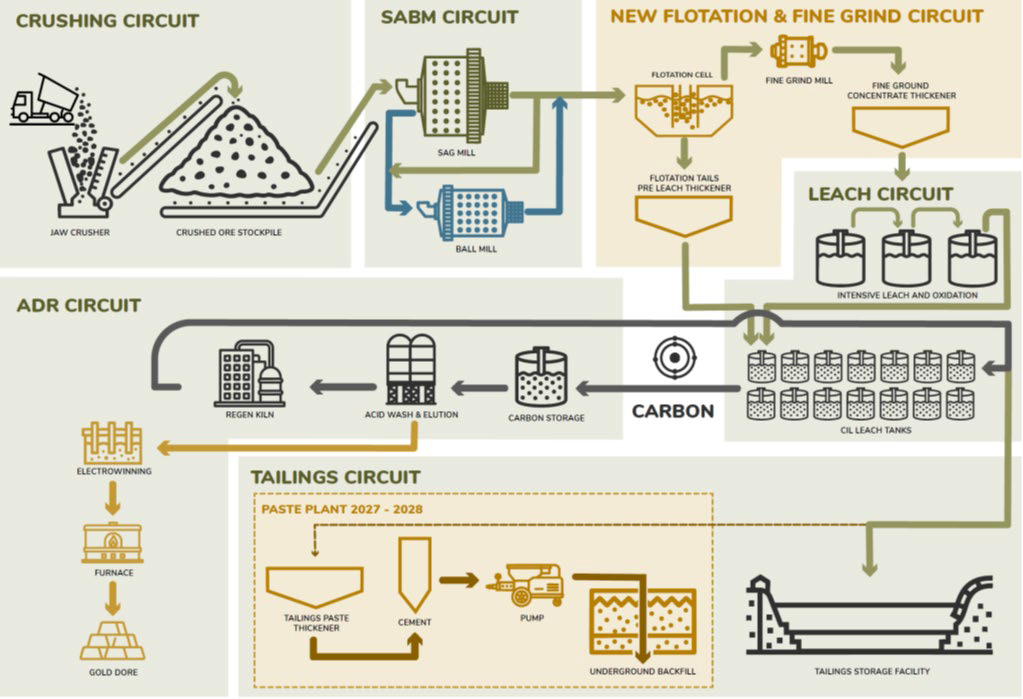

- Process Plant Expansion and Upgrades Progressing: During Q1 2026, the Company announced it has begun executing on a larger processing facility than was initially contemplated in the PEA, consisting of a 3,000+ tpd processing circuit for sulphide material as well as a 1,000 tpd processing circuit for oxide and transition material, and tailings retreatment, while also being capable of processing sulphide material. The newly designed processing plant expansion is now expected to produce average annual gold production in excess of the 62,000 ounces of gold published in the PEA and is expected to be financed from internally generated cashflow over the next 18-24 months. During Q1 2026 the Company made progress on upgrades to the 2,000 tpd plant and the expansion to a 3,000+ tpd processing plant, including finalization of procurement and accelerated manufacturing for several key components, including the pre-leach thickener, upgraded agitators & interstage screens, Aachen reactor, oxygen plant, ADR plant and new gold room, and apron feeder & belt magnet. The plant upgrades are scheduled for completion in fiscal 2026 and are expected to boost plant reliability and performance.

- Continued to Strengthen Working Capital and Expand Stockpile Inventory on ROM Pad: During Q1 2026, the Company continued to strengthen its working capital position through increased production, organically generated cashflow, improved liquidity and an increase in stockpile inventory. As a result, the Company's current ratio has improved from approximately 1.3 at August 31, 2025 to approximately 1.7 at November 30, 2025, after adjusting for non-cash liabilities. During Q1 2026, the Company continued to invest in mine development, mill optimizations, and run of mine (ROM) stockpile inventory. The ROM stockpile has grown from approximately 15,162 ounces of contained gold at August 31, 2025, to an estimated 19,698 ounces of contained gold as at November 30, 2025. Subsequent to Q1 2026, the ROM pad stockpile has increased further to an estimated 22,891 ounces of contained gold, an increase of 3,193 ounces compared to November 30, 2025, as the Company continued to access higher grade ore blocks in the pit and processed a higher proportion of high grade mined material.

- Exploration Plans Advancing: During Q1 2026, the Company began the first phase of the fiscal 2026 exploration program by completing a detailed 810 line-kilometer ground magnetic survey in October 2025. This high-resolution geophysical survey is designed to map subsurface magnetic variations across the tenement area, helping to identify structural features, lithological contacts, and potential mineralized zones with the goal of generating new drilling targets. A final geological interpretation is expected in fiscal Q2 2026.

- Metallurgical Testwork Underway: During Q1 2026, the Company focused on metallurgical testwork programs including (i) gold deportment testing across various geo-metallurgical domains within the Buckreef Main Zone, (ii) flotation and concentrate leach optimization testwork, and (iii) SAG and Ball Mill Circuit Design, as part of its current flowsheet optimization and future expanded flowsheet development. Testwork was completed in the areas of flotation, fine-grinding and intensive leaching. Flotation testwork continued to deliver positive recoveries of 88% - 91.5% and fine grinding and intensive leaching testwork indicated that positive recoveries of flotation concentrate are achieve at a p80 of 20 microns. Final analysis of these results, along with fine grind concentrate settling rates, are expected to be received in fiscal Q2 2026.

- Strong Health, Safety, and Environmental Track Record: The Company achieved zero lost time injuries ("LTI") and there were no reportable environmental incidents during Q1 2026.

Selected Operating and Financial Data

Select operating and financial information from the operation for the three months ended November 30, 2025, follows below:

| Unit | Three months ended November 30, 2025 | Three months ended November 30, 2024 | |

| Operating Data | |||

| Ore Mined | k tonnes | 227 | 103 |

| Waste Mined | k tonnes | 1,129 | 821 |

| Total Mined | k tonnes | 1,356 | 924 |

| Strip Ratio | w:o | 5.0 | 8.0 |

| Mining Rate | tpd | 14,903 | 10,154 |

| Mining Cost | US$/t | $4.76 | $4.00 |

| Plant Ore Milled | k tonnes | 140 | 155 |

| Head Grade | g/t | 1.88 | 1.29 |

| Plant Utilization | % | 90 | 88 |

| Plant Recovery Rate | % | 75 | 72 |

| Processing Cost | US$/t | $19.75 | $12.60 |

| Plant Mill Throughput | tpd | 1,540 | 1,703 |

| Gold Ounces Poured | oz | 6,597 | 4,841 |

| Gold Ounces Sold | oz | 6,492 | 4,813 |

| Financial Data | |||

| Revenue1 | $ ('000s) | 25,117 | 12,528 |

| Gross Profit | $ ('000s) | 14,215 | 4,834 |

| Net (loss) income | $ ('000s) | (496) | 2,137 |

| Adjusted net income2 | $ ('000s) | 7,732 | 1,872 |

| Adjusted EBITDA2 | $ ('000s) | 13,211 | 4,394 |

| Operating Cash Flow | $ ('000s) | 4,020 | 2,381 |

| Adjusted working capital | $ ('000s) | 14,994 | 5,725 |

| Average Realized Price (gross)2 | $/oz | 3,869 | 2,603 |

| Average Realized Price (net)2,3,4 | $/oz | 3,860 | 2,653 |

| Cash Cost2 | $/oz | 1,508 | 1,410 |

| 1 Revenue includes immaterial amounts from the sale of by-product silver and copper. | |||

| 2 Refer to the "Non-IFRS Performance Measures" section. | |||

| 3 Net of revenue and ounces of gold sold related to OCIM gold prepaid purchase agreement. | |||

| 4 Net of interest related to Auramet gold prepaid purchase agreement. | |||

Figure 1: Buckreef Gold's Open Pit Mining Operations

Figure 2: Load and Haul Operations at Buckreef Gold

Figure 3: Load and Haul with New 374 Excavator and Haul Truck

Figure 4: Revised Process Flowsheet for the Upgraded and Expanded Plant

Figure 5: 18 Meter Diameter Pre-Leach Thickener

Figure 6: Pre-Leach Thickener Foundation Civils in progress

Figure 7: Aachen ® Reactor ready for shipment and Vendor Testwork Flotation Cells

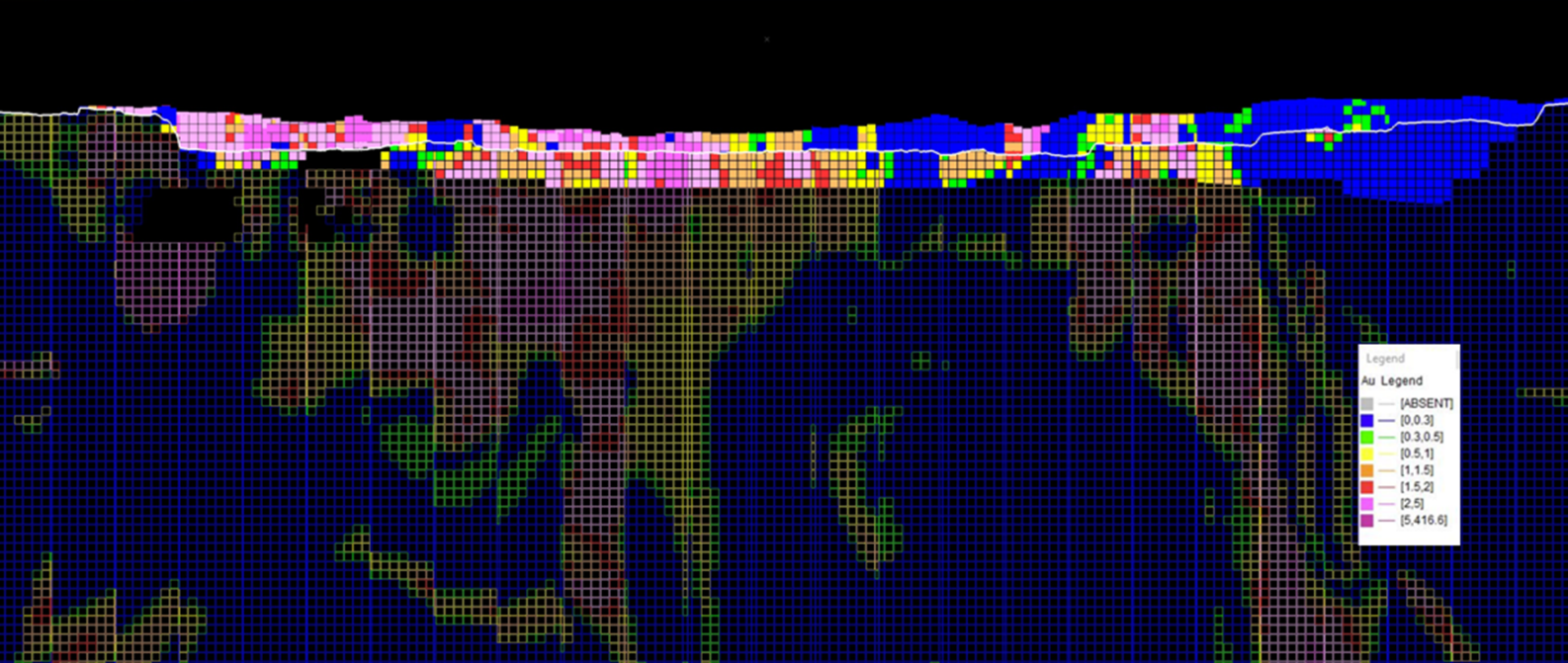

Figure 8: Buckreef Gold fiscal 2026 Mine Plan (including Ore Mined to Date above line)

Q1 2026 Results Conference Call and Webcast Details

When: Monday, January 19th at 10:00 AM EST

Webcast link: https://www.c-meeting.com/web3/joinTo/MP9MKT3Z8WQC2Z/qOjpyfonjHbsPlv9iK5IQQ

Conference call numbers:

Canada/USA TF: 1-833-752-3900

International Toll: +1-647-849-3080

A replay will be made available for 30 days following the call on the Company's website.

About TRX Gold Corporation

TRX Gold is a high margin and growing gold company advancing the Buckreef Gold Project in Tanzania. Buckreef Gold includes an established open pit operation and 2,000 tonnes per day process plant with upside potential demonstrated in the May 2025 PEA. The PEA outlines average gold production of 62,000 oz per annum over 17.6 years at 3,000 tonnes per day of throughput capacity, and US$1.9 billion pre-tax NPV5% at average life of mine gold price of US$4,000/oz2. The Buckreef Gold Project hosts a Measured and Indicated Mineral Resource of 10.8 million tonnes ("MT") at 2.57 grams per tonne ("g/t") gold containing 893,000 ounces ("oz") of gold and an Inferred Mineral Resource of 9.1 MT at 2.47 g/t gold for 726,000 oz of gold. The leadership team is focused on creating both near-term and long-term shareholder value by increasing gold production to generate positive cash flow to fund the expansion as outlined in the PEA and grow Mineral Resources through exploration. TRX Gold's actions are informed by the highest environmental, social and corporate governance ("ESG") standards, as evidenced by the relationships and programs that the Company has developed during its nearly two decades of presence in the Geita Region, Tanzania.

Qualified Person

Mr. Richard Boffey, BE Mining (Hons) F AusIMM, Chief Operating Officer of TRX Gold Corporation, is the Company's in-house Qualified Person under National Instrument 43-101 "Standards of Disclosure for Mineral Projects" ("NI 43-101") and has reviewed and assumes responsibility for the scientific and technical content in this press release.

For investor or shareholder inquiries, please contact:

Investors:

Investor Relations

[email protected]

+1-437-224-5241

+1 844 GOLD TRX (844-465-3879)

www.TRXgold.com

Non-IFRS Performance Measures

The Company has included certain non-IFRS measures in this news release. The following non-IFRS measures should be read in conjunction with the Company's Unaudited Interim Condensed Consolidated Financial Statements for the quarter ended November 30, 2025 filed on SEDAR+ and with the Securities and Exchange Commission ("SEC"), as well as the Company's audited consolidated financial statements included in the Company's Annual Report on Form 40-F and Annual Information Form for the year ended August 31, 2025. The financial statements and related notes of TRX Gold have been prepared in accordance with International Financial Reporting Standards ("IFRS"). Additional information has been filed electronically on SEDAR+ and with the SEC and is available online under the Company's profile at www.sedarplus.ca and the Company's filings with the SEC at www.sec.gov and on our website at www.TRXgold.com.

EBITDA

EBITDA is a non-IFRS performance measure and does not constitute a measure recognized by IFRS and does not have a standardized meaning defined by IFRS. EBITDA may not be comparable to information in other gold producers' reports and filings. EBITDA is presented as a supplemental measure of the Company's performance and ability to service its obligations. EBITDA is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the industry, many of which present EBITDA when reporting their results. Issuers present EBITDA because investors, analysts and rating agencies consider it useful in measuring the ability of those issuers to meet their obligations. EBITDA represents net income before interest, income taxes, and depreciation and also eliminates the impact of a number of items that are not considered indicative of ongoing operating performance.

The following table provides a reconciliation of net (loss) income and comprehensive (loss) income to EBITDA per the Unaudited Interim Condensed Consolidated Financial Statements for the three months ended November 30, 2025:

Expressed in thousands of US dollars

| Three Months Ended | Three Months Ended | |

| November 30, 2025 | November 30, 2024 | |

| Net (loss) income and comprehensive (loss) income per financial statements | (496) | 2,137 |

| Add: | ||

| Interest, net and other expense | 334 | 321 |

| Income tax expense | 5,028 | 1,693 |

| Change in fair value of derivative financial instruments | 7,000 | (819) |

| Share-based payment expense | 236 | 156 |

| EBITDA | 13,211 | 4,394 |

Average realized price per ounce gold sold

Average realized price per ounce of gold sold is a non-IFRS measure and does not constitute a measure recognized by IFRS and does not have a standardized meaning defined by IFRS. Average realized price per ounce of gold sold is calculated by dividing revenue by ounces of gold sold. It may not be comparable to information in other gold producers' reports and filings.

The following table provides a reconciliation of average realized price per ounce of gold sold to revenue per the Unaudited Interim Condensed Consolidated Financial Statements for the three months ended November 30, 2025:

Expressed in thousands of US dollars except for ounces of gold and average realized price

| Three Months Ended | Three Months Ended | |||||

| November 30, 2025 | November 30, 2024 | |||||

| Revenue per financial statements | $ | 25,117 | $ | 12,528 | ||

| Interest recognized from Auramet prepaid gold purchase agreement | (59) | - | ||||

| Revenue recognized from OCIM prepaid gold purchase agreement | - | (915) | ||||

| Revenue from gold sales | 25,058 | 11,613 | ||||

| Ounces of gold sold | 6,492 | 4,813 | ||||

| Ounces of gold sold from OCIM prepaid gold purchase agreement | - | (435) | ||||

| Ounces from gold sales (net of OCIM prepaid gold purchase agreement) | 6,492 | 4,378 | ||||

| Average realized price (gross) | $ | 3,869 | $ | 2,603 | ||

| Average realized price (net) | $ | 3,860 | $ | 2,653 | ||

Cash cost per ounce of gold sold

Cash cost per ounce of gold sold is a non-IFRS performance measure and does not constitute a measure recognized by IFRS and does not have a standardized meaning defined by IFRS. Cash cost per ounce may not be comparable to information in other gold producers' reports and filings. The following table provides a reconciliation of total cash cost per ounce of gold sold to cost of goods sold per the financial statements for the three months ended November 30, 2025:

Expressed in thousands of US dollars except for references to ounces of gold

| Three Months Ended | Three Months Ended | |||||

| November 30, 2025 | November 30, 2024 | |||||

| Cost of sales per financial statements | $ | 10,902 | $ | 7,694 | ||

| Less: | ||||||

| Depreciation | $ | (1,109 | ) | $ | (906 | ) |

| Total cash cost | $ | 9,793 | $ | 6,788 | ||

| Ounces of gold sold | 6,492 | 4,813 | ||||

| Cash cost per ounce of gold sold | $ | 1,508 | $ | 1,410 | ||

Adjusted Net Income

Adjusted Net Income is a non-IFRS performance measure and does not constitute a measure recognized by IFRS and does not have a standardized meaning defined by IFRS. Adjusted Net Income may not be comparable to information in other gold producers' reports and filings. Adjusted Net Income is presented as a supplemental measure of the Company's performance. Adjusted Net Income is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the industry, many of which present Adjusted Net Income when reporting their results.

Management uses this measure internally to evaluate the underlying operating performance for the reporting periods presented. Management believes that Adjusted Net Income is a useful measure of performance because the items excluded from Net Income do not reflect the underlying operating performance of the core mining business and are not necessarily indicative of future operating results.

The Company presents Adjusted Net Income to enable investors, analysts and rating agencies to better understand the underlying operating performance of the core mining business through the eyes of management. Adjusted Net Income is a non-IFRS financial measure which excludes the following from net income (loss): foreign exchange losses (gains), interest and other expense, change in fair value of derivative instruments, and share-based expenses, which are not considered indicative of the Company's underlying operating results for the reporting periods presented or for future operating performance.

The following table provides a reconciliation of net (loss) income and comprehensive (loss) income to Adjusted Net Income per the financial statements for the three months ended November 30, 2025:

Expressed in thousands of US dollars

| Three Months Ended | Three Months Ended | |

| November 30, 2025 | November 30, 2024 | |

| Net (loss) income and comprehensive (loss) income per financial statements | (496) | 2,137 |

| Add: | ||

| Foreign exchange losses (gains) | 658 | 77 |

| Interest, net and other expense | 334 | 321 |

| Change in fair value of derivative financial instruments | 7,000 | (819) |

| Share-based payment expense | 236 | 156 |

| Adjusted Net Income | 7,732 | 1,872 |

The Company has included "EBITDA", "average realized price per ounce of gold sold", "cash cost per ounce of gold sold" and "Adjusted Net Income" and as non-IFRS performance measures throughout this news release as TRX Gold believes that these generally accepted industry performance measures provide a useful indication of the Company's operational performance. The Company believes that certain investors use this information to evaluate the Company's performance and ability to generate cash flow. Accordingly, they are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

Forward-Looking and Cautionary Statements

This press release contains certain forward-looking statements as defined in the applicable securities laws. All statements, other than statements of historical facts, are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as "expects", "anticipates", "believes", "hopes", "intends", "estimated", "potential", "possible" and similar expressions, or statements that events, conditions or results "will", "may", "could" or "should" occur or be achieved. Forward-looking statements relate to future events or future performance and reflect TRX Gold management's expectations or beliefs regarding future events and include, but are not limited to, statements with respect to anticipated gold production, anticipated capital and exploration expenditures, continued operating cash flow, expansion of its process plant, estimation of mineral resources, ability to develop value creating activities, recoveries, subsequent project testing, success, scope and viability of mining operations, and the timing and amount of estimated future production.

Although TRX Gold believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance. The actual achievements of TRX Gold or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors. These risks, uncertainties and factors include general business, legal, economic, competitive, political, regulatory and social uncertainties; actual results of exploration activities and economic evaluations; fluctuations in currency exchange rates; changes in costs; future prices of gold and other minerals; mining method, production profile and mine plan; delays in exploration, development and construction activities; changes in government legislation and regulation; the ability to obtain financing on acceptable terms and in a timely manner or at all; contests over title to properties; employee relations and shortages of skilled personnel and contractors; the speculative nature of, and the risks involved in, the exploration, development and mining business. These risks are set forth in reports that TRX Gold files with the SEC and the various Canadian securities authorities. You can review and obtain copies of these filings from the SEC's website at http://www.sec.gov/edgar.shtml and the Company's profile on the System for Electronic Document Analysis and Retrieval ("SEDAR+") at www.sedarplus.ca.

The disclosure contained in this press release of a scientific or technical nature relating to the Company's Buckreef Project has been summarized or extracted from the technical report prepared in accordance with NI 43-101 – Standards of Disclosure for Mineral Projects on the Buckreef Gold Project ("Buckreef Gold") titled Preliminary Economic Assessment and Updated Mineral Resource Estimate of the Buckreef Gold Mine Project, Tanzania ("PEA") with an effective date of April 15, 2025. The PEA was prepared in accordance with NI 43-101 guidelines by P&E Mining Consultants Inc. ("P&E"). Input to this PEA was also provided by D.E.N.M. Engineering Ltd. ("D.E.N.M."). The information contained herein is subject to all of the assumptions, qualifications and procedures set out in, and is qualified in its entirety by reference to the full text of, the PEA and reference should be made to the full details of the PEA which has been filed with the applicable regulatory authorities and is available on the Company's profile at www.sedarplus.ca.

The information contained in this press release is as of the date of the press release and TRX Gold assumes no duty to update such information.

____________________________________

1 Refer to "Non-IFRS Performance Measures" section.

2 Base case NPV5% of US$701.0 million pre-tax, or US$442.2 million after tax at consensus forecast case gold prices (US$2,707/oz year 1, US$2,646/oz year 2, US$2,495/oz year 3, US$2,400/oz year 4, US$2,245/oz thereafter).

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/418ae9ac-d660-48c0-bf34-7ecdd41c5129

https://www.globenewswire.com/NewsRoom/AttachmentNg/7f6262a5-2444-4536-8b9b-60d22f81ed78

https://www.globenewswire.com/NewsRoom/AttachmentNg/56107614-ab4d-4dd2-b1d3-fe4b799d239a

https://www.globenewswire.com/NewsRoom/AttachmentNg/b64c8034-c32d-4959-8393-8324cc7c185e

https://www.globenewswire.com/NewsRoom/AttachmentNg/38e687bf-391e-4da9-b053-880f3f1d6199

https://www.globenewswire.com/NewsRoom/AttachmentNg/3bb4fcc2-dc80-4ebe-abf9-c6252470cda6

https://www.globenewswire.com/NewsRoom/AttachmentNg/a17c07dd-496a-4994-967e-b7eb64830ff6

https://www.globenewswire.com/NewsRoom/AttachmentNg/36cbce50-e33b-478b-aab4-6eecb7f9e645